XAG/USD: technical analysis

11 September 2017, 08:52

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | SELL STOP |

| Entry Point | 17.70 |

| Take Profit | 17.20 |

| Stop Loss | 17.95 |

| Key Levels | 17.00, 17.20, 17.30, 17.50, 17.70, 17.95, 18.20, 18.50, 18.75 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 18.00 |

| Take Profit | 18.50 |

| Stop Loss | 17.70 |

| Key Levels | 17.00, 17.20, 17.30, 17.50, 17.70, 17.95, 18.20, 18.50, 18.75 |

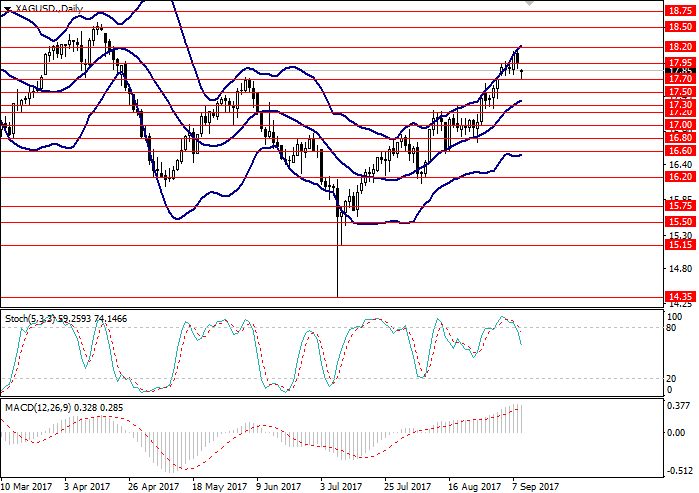

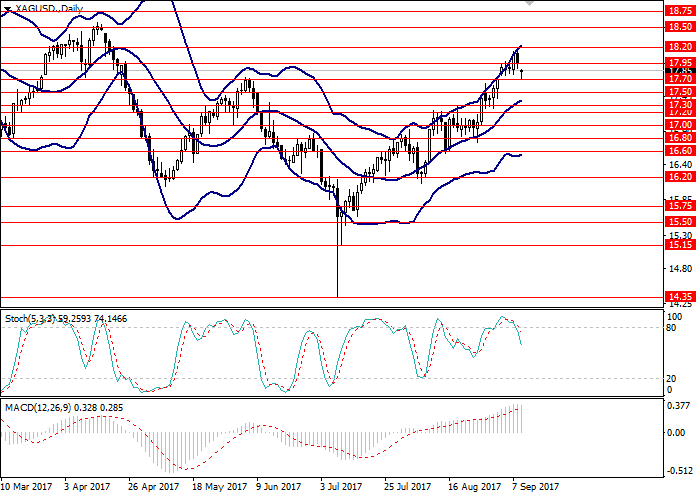

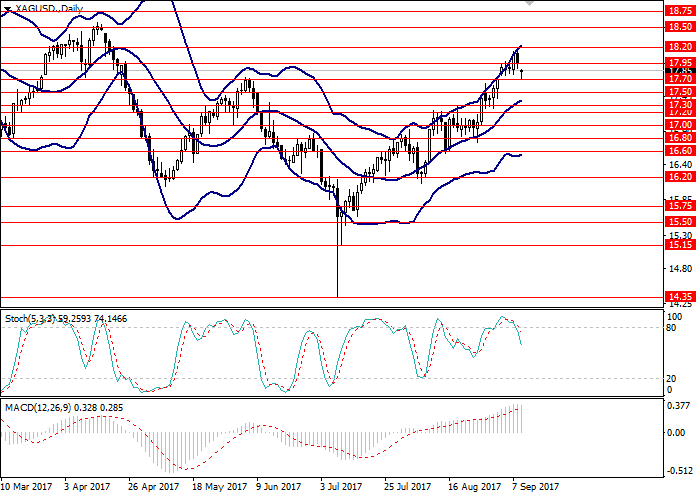

XAG/USD, D1

D1 chart shows the correction of upward movement. The pair is trading between the upper and middle lines of Bollinger Bands. The nearest support level is 17.70, and the level of resistance is 17.95. MACD histogram is in the positive zone, the signal line is crossing the body of the histogram from below, giving a signal for opening buy orders. Stochastic is crossing the overbought area from above, giving a signal for the opening of short orders.

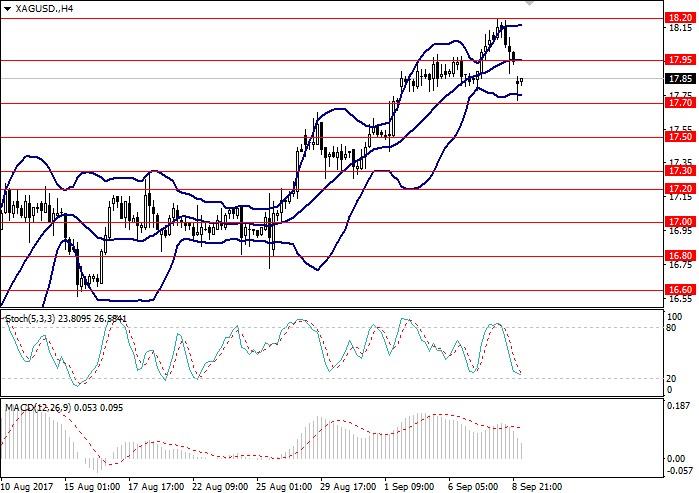

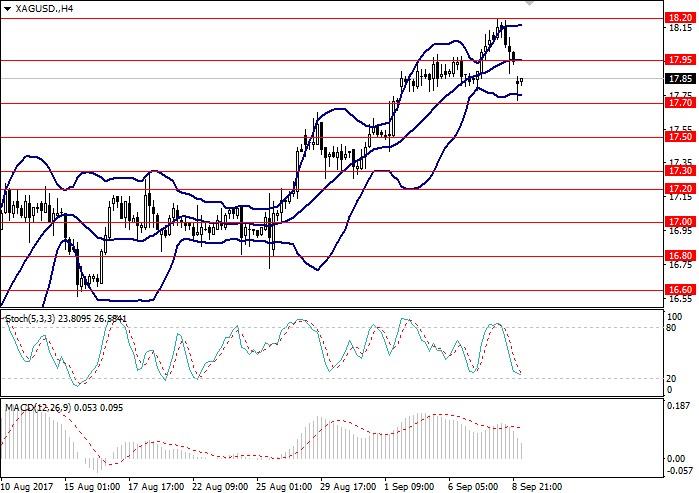

XAG/USD, H4

On the H4 chart the instrument is moving in the narrow range formed by the borders of Bollinger Bands. MACD histogram is in positive zone reducing its volume, the signal line is outside its body, not giving any clear signals for opening the market. Stochastic is moving towards the border beween the neutral zone and the oversold zone keeping a signal for opening sales orders.

Key levels

Support levels: 17.70, 17.50, 17.30, 17.20, 17.00.

Resistance levels: 17.95, 18.20, 18.50, 18.75.

Trading tips

According to technical indicators, short positions could be opened from the level of 17.70 with target at 17.20 and stop-loss at 17.95.

Long positions may be opened from the level of 18.00 with target at 18.50. Stop-loss should be placed at 17.70.

The period of implementation is 1-3 days.

D1 chart shows the correction of upward movement. The pair is trading between the upper and middle lines of Bollinger Bands. The nearest support level is 17.70, and the level of resistance is 17.95. MACD histogram is in the positive zone, the signal line is crossing the body of the histogram from below, giving a signal for opening buy orders. Stochastic is crossing the overbought area from above, giving a signal for the opening of short orders.

XAG/USD, H4

On the H4 chart the instrument is moving in the narrow range formed by the borders of Bollinger Bands. MACD histogram is in positive zone reducing its volume, the signal line is outside its body, not giving any clear signals for opening the market. Stochastic is moving towards the border beween the neutral zone and the oversold zone keeping a signal for opening sales orders.

Key levels

Support levels: 17.70, 17.50, 17.30, 17.20, 17.00.

Resistance levels: 17.95, 18.20, 18.50, 18.75.

Trading tips

According to technical indicators, short positions could be opened from the level of 17.70 with target at 17.20 and stop-loss at 17.95.

Long positions may be opened from the level of 18.00 with target at 18.50. Stop-loss should be placed at 17.70.

The period of implementation is 1-3 days.

No comments:

Write comments