WTI Crude Oil: new threat to US oil production

06 September 2017, 14:01| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY |

| Entry Point | 49.38 |

| Take Profit | 50.00, 51.50 |

| Stop Loss | 48.60 |

| Key Levels | 45.31, 47.20, 48.43, 49.00, 50.05, 51.56 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 48.30 |

| Take Profit | 47.20, 45.30 |

| Stop Loss | 48.80 |

| Key Levels | 45.31, 47.20, 48.43, 49.00, 50.05, 51.56 |

Current trend

This week oil prices are growing and have reached the level of 49.00. The trend is due to the increase of demand of US oil production plants, which began to work again after the end of hurricane Harvey. According to EIA, on Tuesday six of Mexican gulf coast plants were working partly, five more were restarting and one has began to work fully.

The prices were supported by the news that new hurricane Irma is approaching the US cost, and the consequences of it can be more harmful. It is expected to reach Texas and Louisiana cost by next Wednesday, and gas and oil production rigs would be damaged.

On the other hand, the US currency was under the pressure due to commentaries of Fed’s administration member Lael Brainard, who considered the level of the base inflation insufficient to increase the interest rate in the nearest future.

Today the investors are focused on the API Weekly Crude Oil Stock publication, which was postponed on Wednesday due to the celebrating of the Labour Day in the USA. During last four weeks the recourses have been decreasing (by 5.392K barrel last time), but the current report can reflect the growth, as hurricane Harvey stopped from working parts of the transport infrastructure, pipelines and ports. In this case the growth of prices can slow.

Support and resistance

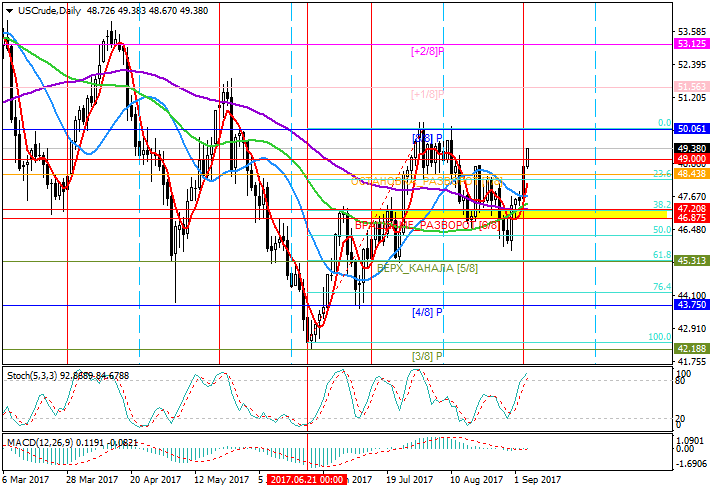

Technically the price grew above the level of 48.43 (Fibonacci correction 23.6%, Murray [7/8]) and can go up to the area of July highs to the level of 50.05 (Murray [8/8]) and higher to 51.56 (Murray [+1/8]). The key issue for “bears” is the consolidation of the price below the level of 48.43. In this case the price can fall to the area of 47.20–46.87 (Fibonacci correction 38.2%, Murray [6/8]) and 45.31 (Fibonacci correction 61.8%, Murray [5/8]).

Resistance levels: 49.00, 50.05, 51.56.

Support levels: 48.43, 47.20, 45.31.

Trading tips

Long positions can be opened significantly above the level of 49.00 with the targets at 50.00, 51.50 and stop loss at 48.60.

Short positions can be opened below the level of 48.40 with the targets at 47.20, 45.30 and stop loss at 48.80.

This week oil prices are growing and have reached the level of 49.00. The trend is due to the increase of demand of US oil production plants, which began to work again after the end of hurricane Harvey. According to EIA, on Tuesday six of Mexican gulf coast plants were working partly, five more were restarting and one has began to work fully.

The prices were supported by the news that new hurricane Irma is approaching the US cost, and the consequences of it can be more harmful. It is expected to reach Texas and Louisiana cost by next Wednesday, and gas and oil production rigs would be damaged.

On the other hand, the US currency was under the pressure due to commentaries of Fed’s administration member Lael Brainard, who considered the level of the base inflation insufficient to increase the interest rate in the nearest future.

Today the investors are focused on the API Weekly Crude Oil Stock publication, which was postponed on Wednesday due to the celebrating of the Labour Day in the USA. During last four weeks the recourses have been decreasing (by 5.392K barrel last time), but the current report can reflect the growth, as hurricane Harvey stopped from working parts of the transport infrastructure, pipelines and ports. In this case the growth of prices can slow.

Support and resistance

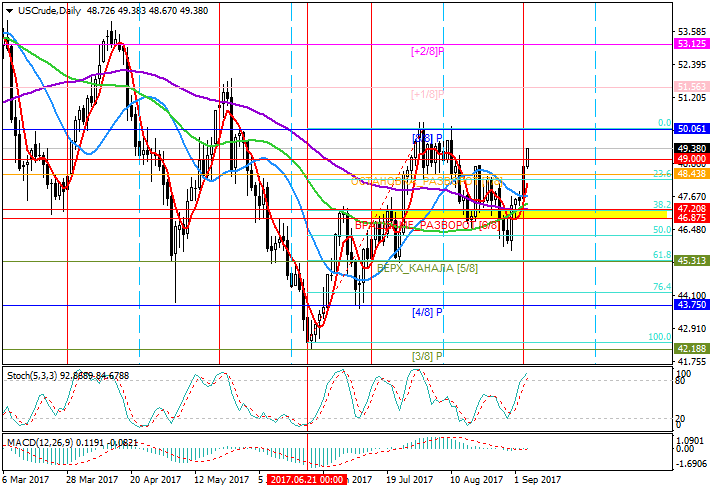

Technically the price grew above the level of 48.43 (Fibonacci correction 23.6%, Murray [7/8]) and can go up to the area of July highs to the level of 50.05 (Murray [8/8]) and higher to 51.56 (Murray [+1/8]). The key issue for “bears” is the consolidation of the price below the level of 48.43. In this case the price can fall to the area of 47.20–46.87 (Fibonacci correction 38.2%, Murray [6/8]) and 45.31 (Fibonacci correction 61.8%, Murray [5/8]).

Resistance levels: 49.00, 50.05, 51.56.

Support levels: 48.43, 47.20, 45.31.

Trading tips

Long positions can be opened significantly above the level of 49.00 with the targets at 50.00, 51.50 and stop loss at 48.60.

Short positions can be opened below the level of 48.40 with the targets at 47.20, 45.30 and stop loss at 48.80.

No comments:

Write comments