USD/JPY: waiting for the decisions of the Fed

20 September 2017, 12:20

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | SELL STOP |

| Entry Point | 110.90 |

| Take Profit | 110.15, 109.35 |

| Stop Loss | 111.30 |

| Key Levels | 109.35, 110.15, 110.90, 111.90, 112.50, 112.75 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 112.00 |

| Take Profit | 112.50, 112.75 |

| Stop Loss | 111.60 |

| Key Levels | 109.35, 110.15, 110.90, 111.90, 112.50, 112.75 |

Current trend

This week the pair was trading in the range of 111.30-111.70. Relative calmness on the Korean peninsula and the expectation of the outcome of the Fed meeting did not contribute to the activity of investors.

Published today, August data on Japan's trade balance also failed to stir the market, although the size of the surplus exceeded the expectations of experts and amounted to 113.6 billion yen.

The most important event of the week is still the meeting of the American regulator. Today, the Fed members will decide on the interest rate and hold a press conference. It is expected that the rate will remain at the same level of 1.25%, especially since there are no special reasons for raising it. Inflation is still unstable: the base consumer price index has been at the level of 1.7% for four months in a row already. In addition, the situation on the labor market worsened in August – the unemployment rate began to grow again and reached the level of 4.3%. On the other hand, in order not to disappoint investors, FOMC can announce the beginning of a reduction in the balance sheet, which has already exceeded 4.4 trillion dollars. Also, the market's attention will be focused on the press conference of the head of the Fed, Janet Yellen, who can shed light on the further actions of the regulator.

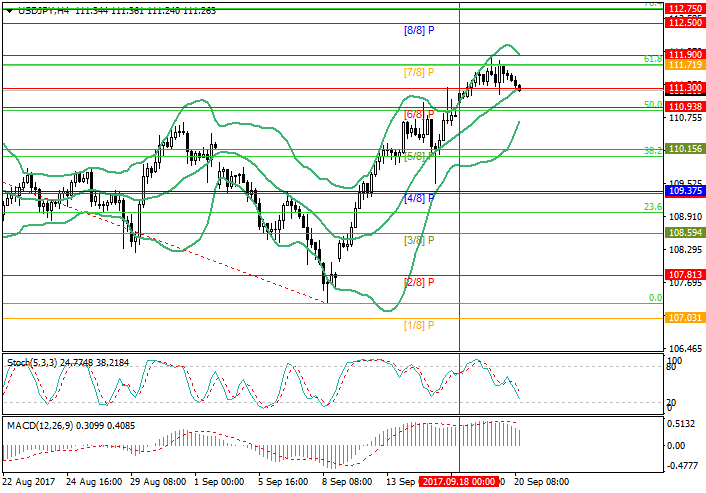

Support and resistance

Technically, the price is in the mid-range of the Bollinger bands and, in case of breakdown of the middle line the price may begin to decline. However, with a decrease of the price another important level will arise at 110.90 (Fibonacci correction 50.0%, Murray level [6/8]), in its breakdown the decline will continue to the levels of 110.15 (Fibonacci correction 38.2%, Murray level [5/8]) and 109.35 (the Murray level [4/8]). The key zone for “bulls” will be 111.90-111.70, with its breakout, growth can continue to levels of 112.50 (Murray level [8/8]) and 112.75 (Fibonacci retracement of 76.4%). Technical indicators show continuation of correction: Stochastic is directed downwards, MACD histogram is falling in the positive zone.

Support levels: 110.90, 110.15, 109.35.

Resistance levels: 111.90, 112.50, 112.75.

Trading tips

In the current situation, short positions should be opened at the level of 110.90 with targets of 110.15, 109.35 and stop-loss at 111.30. Long positions should be opened above the level of 111.90 with targets at 112.50, 112.75 and stop-loss at 111.60.

This week the pair was trading in the range of 111.30-111.70. Relative calmness on the Korean peninsula and the expectation of the outcome of the Fed meeting did not contribute to the activity of investors.

Published today, August data on Japan's trade balance also failed to stir the market, although the size of the surplus exceeded the expectations of experts and amounted to 113.6 billion yen.

The most important event of the week is still the meeting of the American regulator. Today, the Fed members will decide on the interest rate and hold a press conference. It is expected that the rate will remain at the same level of 1.25%, especially since there are no special reasons for raising it. Inflation is still unstable: the base consumer price index has been at the level of 1.7% for four months in a row already. In addition, the situation on the labor market worsened in August – the unemployment rate began to grow again and reached the level of 4.3%. On the other hand, in order not to disappoint investors, FOMC can announce the beginning of a reduction in the balance sheet, which has already exceeded 4.4 trillion dollars. Also, the market's attention will be focused on the press conference of the head of the Fed, Janet Yellen, who can shed light on the further actions of the regulator.

Support and resistance

Technically, the price is in the mid-range of the Bollinger bands and, in case of breakdown of the middle line the price may begin to decline. However, with a decrease of the price another important level will arise at 110.90 (Fibonacci correction 50.0%, Murray level [6/8]), in its breakdown the decline will continue to the levels of 110.15 (Fibonacci correction 38.2%, Murray level [5/8]) and 109.35 (the Murray level [4/8]). The key zone for “bulls” will be 111.90-111.70, with its breakout, growth can continue to levels of 112.50 (Murray level [8/8]) and 112.75 (Fibonacci retracement of 76.4%). Technical indicators show continuation of correction: Stochastic is directed downwards, MACD histogram is falling in the positive zone.

Support levels: 110.90, 110.15, 109.35.

Resistance levels: 111.90, 112.50, 112.75.

Trading tips

In the current situation, short positions should be opened at the level of 110.90 with targets of 110.15, 109.35 and stop-loss at 111.30. Long positions should be opened above the level of 111.90 with targets at 112.50, 112.75 and stop-loss at 111.60.

No comments:

Write comments