GBP/CAD: Ichimoku clouds

06 September 2017, 20:34| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | SELL |

| Entry Point | 1.59347 |

| Take Profit | 1.58360 |

| Stop Loss | 1.60186 |

| Key Levels | 1.58190 1.58360 1.60186 1.60983 |

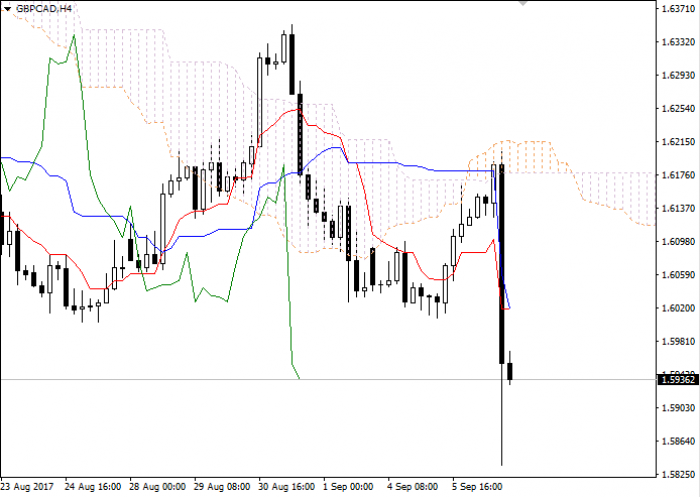

Let's look at the four-hour chart. Tenkan-sen and Kijun-sen lines have merged, both lines are directed downwards. Confirmative line Chikou Span is below the price chart, current cloud is descending. The instrument is trading below Tenkan-sen and Kijun-sen lines; the Bearish trend is still strong. One of the previous minimums of Chikou Span line is expected to be a support level (1.58360). The closest resistance level is Kijun-sen line (1.60186).

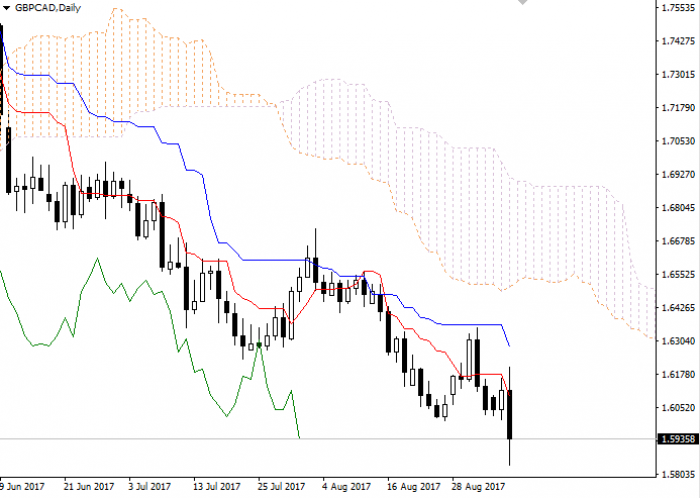

On the daily chart Tenkan-sen line is below Kijun-sen, both lines are directed downwards. Confirmative line Chikou Span is below the price chart, current cloud is descending. The instrument is trading below Tenkan-sen and Kijun-sen lines; the Bearish trend is still strong. One of the previous minimums of Chikou Span line is expected to be a support level (1.58190). The closest resistance level is Tenkan-sen line (1.60983).

On the both charts the instrument is still falling. It is recommended to open long positions at current price with Take Profit at the level of previous maximum of Chikou Span (1.58360) line and Stop Loss at the level of Kijun-sen line (1.60186).

No comments:

Write comments