EUR/USD: broad consolidation after long growth

11 September 2017, 14:07

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | SELL STOP |

| Entry Point | 1.1930, 1.1900 |

| Take Profit | 1.1800, 1.1765 |

| Stop Loss | 1.2010 |

| Key Levels | 1.1575, 1.1600, 1.1630, 1.1670, 1.1730, 1.1800, 1.1885, 1.1990, 1.2030, 1.2100, 1.2170, 1.2230, 1.2300 |

Current trend

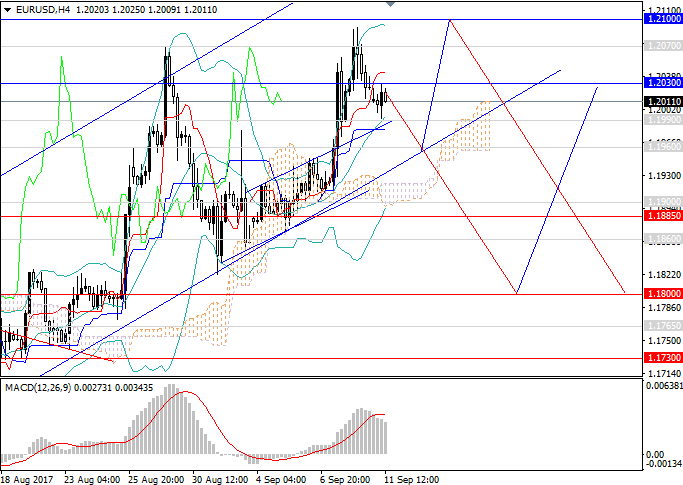

European currency remains in the long-term upward channel against the US dollar, but the upward impulse starts to decrease. Euro against dollar was corrected by over 200 points. After that the pair went up again, but failed to break put the key resistance level of 1.2100 and reversed again. The main catalyst of this movement is gradual decrease of the investors' interest in the overbought European currency.

The pair is under additional pressure from mixed data from Eurozone. At the end of the previous week positive data on the rate of Eurozone economic growth in Q2 were released, but on Friday the situation was spoiled by weak data on German payment and trading balances and changes in the volumes of French industrial output.

No important releases are scheduled for today. At the beginning of the current week special attention should be paid to the data on inflation in Germany and Eurozone industrial output. In the second half of the trading week the data on inflation pressure, industrial output, and key indexes will be released in the USA.

Support and resistance

The breakdown of the lower border of the upward channel will open the pair a way to the next strong support level 1.1800 after which it will move to the consolidation stage in the wide side channel 1.1800, 1.2070. Technical indicators confirm the forecast of the upward movement slowing down. MACD shows the reduction in the volume of long positions, and Bollinger Bands gradually become horizontal.

Support levels: 1.1990, 1.1960, 1.1885, 1.1800, 1.1730, 1.1670, 1.1630, 1.1600, 1.1575.

Resistance levels: 1.2030, 1.2100, 1.2170, 1.2230, 1.2300.

Trading tips

Short pending orders may be opened at 1.1930, 1.1900 with target at 1.1800, 1.1765. Stop-loss may be placed at 1.2010.

European currency remains in the long-term upward channel against the US dollar, but the upward impulse starts to decrease. Euro against dollar was corrected by over 200 points. After that the pair went up again, but failed to break put the key resistance level of 1.2100 and reversed again. The main catalyst of this movement is gradual decrease of the investors' interest in the overbought European currency.

The pair is under additional pressure from mixed data from Eurozone. At the end of the previous week positive data on the rate of Eurozone economic growth in Q2 were released, but on Friday the situation was spoiled by weak data on German payment and trading balances and changes in the volumes of French industrial output.

No important releases are scheduled for today. At the beginning of the current week special attention should be paid to the data on inflation in Germany and Eurozone industrial output. In the second half of the trading week the data on inflation pressure, industrial output, and key indexes will be released in the USA.

Support and resistance

The breakdown of the lower border of the upward channel will open the pair a way to the next strong support level 1.1800 after which it will move to the consolidation stage in the wide side channel 1.1800, 1.2070. Technical indicators confirm the forecast of the upward movement slowing down. MACD shows the reduction in the volume of long positions, and Bollinger Bands gradually become horizontal.

Support levels: 1.1990, 1.1960, 1.1885, 1.1800, 1.1730, 1.1670, 1.1630, 1.1600, 1.1575.

Resistance levels: 1.2030, 1.2100, 1.2170, 1.2230, 1.2300.

Trading tips

Short pending orders may be opened at 1.1930, 1.1900 with target at 1.1800, 1.1765. Stop-loss may be placed at 1.2010.

No comments:

Write comments