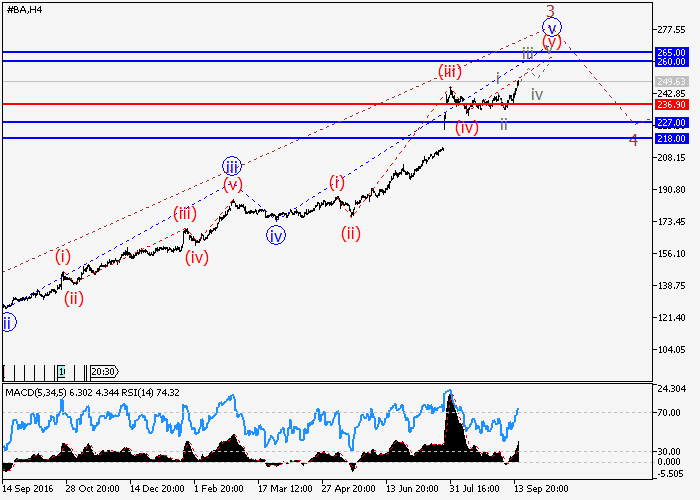

Boeing Company: wave analysis

18 September 2017, 09:38

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY |

| Entry Point | 249.02 |

| Take Profit | 260.00, 265.00 |

| Stop Loss | 245.35 |

| Key Levels | 227.00, 236.90, 260.00, 265.00 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 236.80 |

| Take Profit | 227.00 |

| Stop Loss | 240.10 |

| Key Levels | 227.00, 236.90, 260.00, 265.00 |

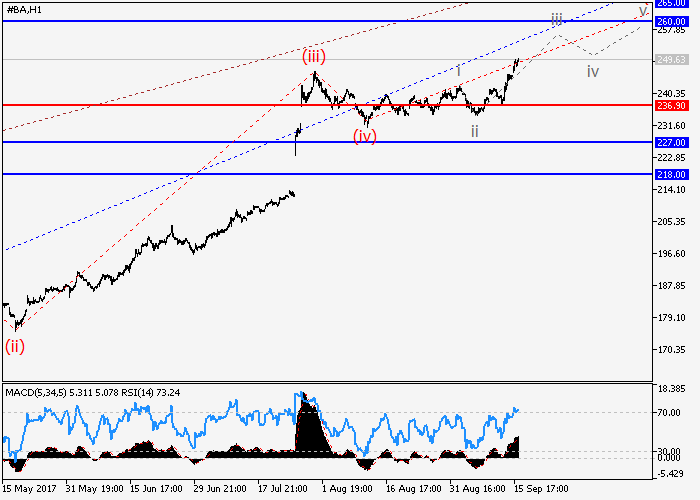

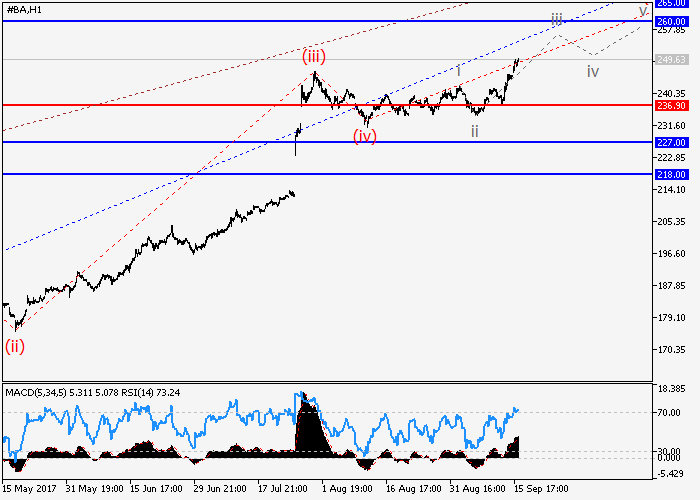

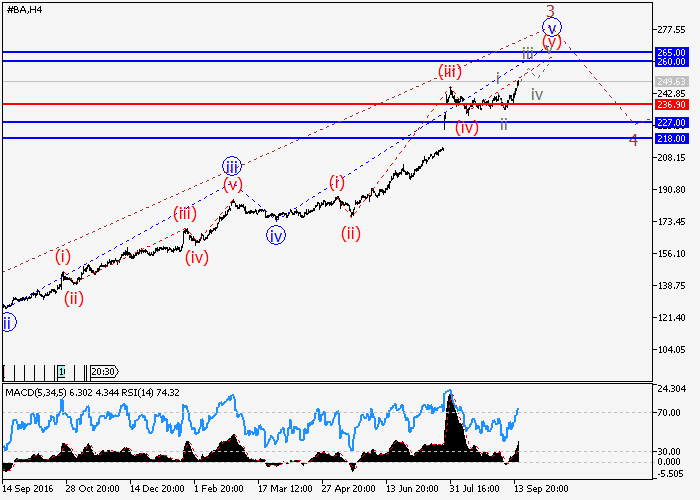

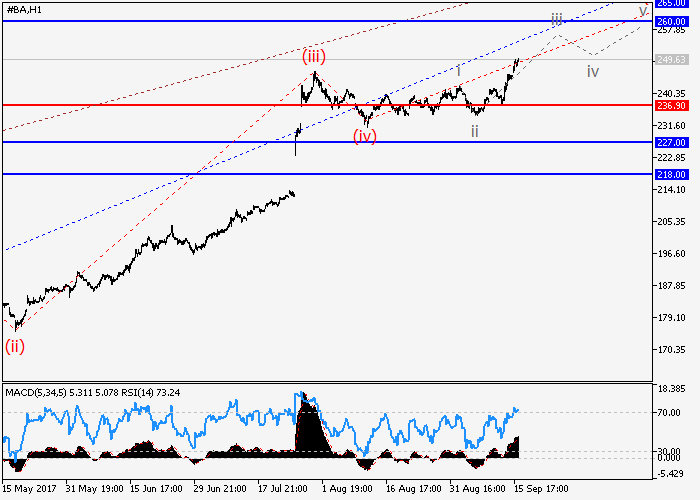

The upward trend is in force.

Presumably, the upward momentum is forming within the fifth wave v in the third wave of the higher level 3. At the moment, the fifth wave of the lower level (v) of v of 3 is developing. If the assumption is true, then the price increase will continue to the area of 260.00-265.00. The level of 236.90 is critical for this scenario.

Main scenario

Buy the asset during corrections, above the level of 236.90 with a target in the range of 260.00-265.00.

Alternative scenario

Breakdown of the level of 236.90 will allow the asset to continue the decline to the level of 227.00.

Presumably, the upward momentum is forming within the fifth wave v in the third wave of the higher level 3. At the moment, the fifth wave of the lower level (v) of v of 3 is developing. If the assumption is true, then the price increase will continue to the area of 260.00-265.00. The level of 236.90 is critical for this scenario.

Main scenario

Buy the asset during corrections, above the level of 236.90 with a target in the range of 260.00-265.00.

Alternative scenario

Breakdown of the level of 236.90 will allow the asset to continue the decline to the level of 227.00.

No comments:

Write comments