XAG/USD: silver prices are going down

04 February 2019, 08:32

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 15.87 |

| Take Profit | 16.00, 16.10, 16.16 |

| Stop Loss | 15.75 |

| Key Levels | 15.47, 15.58, 15.66, 15.75, 15.84, 16.00, 16.16, 16.28 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 15.73 |

| Take Profit | 15.66, 15.58 |

| Stop Loss | 15.80 |

| Key Levels | 15.47, 15.58, 15.66, 15.75, 15.84, 16.00, 16.16, 16.28 |

Current trend

Silver prices dropped significantly on Friday, continuing the development of the "bearish" impetus formed the day before. Negative trend was facilitated by the release of the labor market report and of the data on business activity in the United States.

Nonfarm Payrolls rose from 222K to 304K, with the expected decline to 165K. At the same time, the Unemployment Rate in January unexpectedly rose from 3.9% to 4.0%, while the Average Hourly Earnings grew by only 0.1% MoM with an expected growth of 0.3% MoM.

In turn, Markit Manufacturing PMI in January remained at the same level of 54.9 points. ISM Manufacturing PMI jumped from 54.3 to 56.6 points with the expected decline to 54.2 points.

Support and resistance

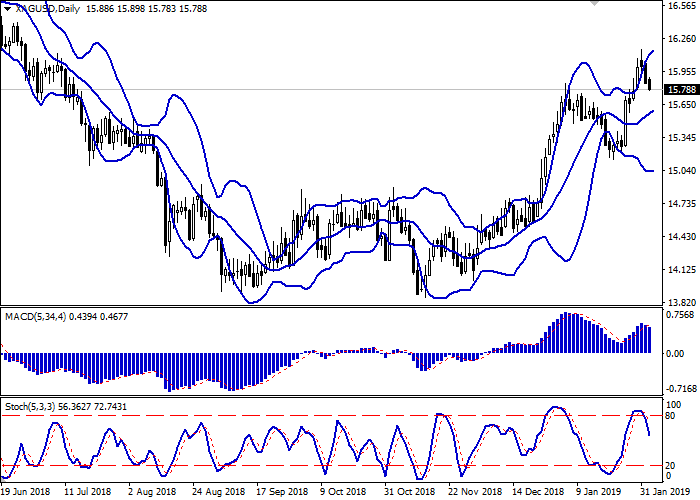

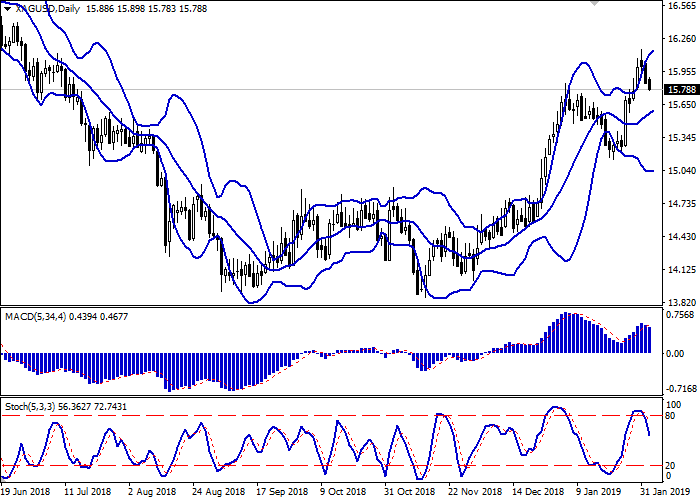

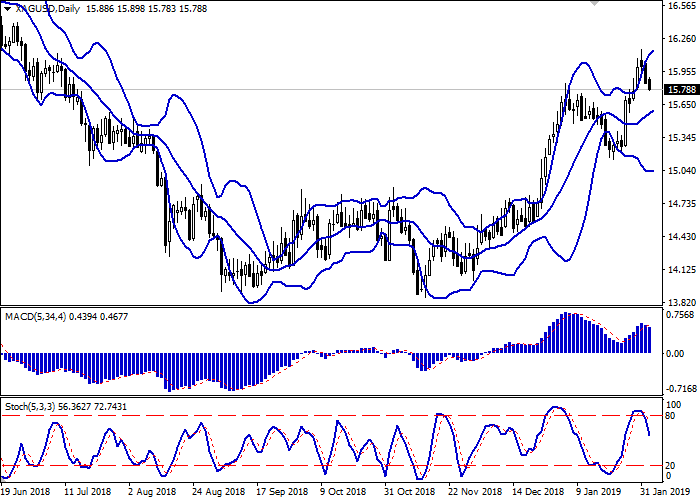

In the D1 chart, Bollinger Bands are reversing horizontally. The price range is actively expanding from above almost not reacting to the appearance of a steady "bearish" trend. MACD is going down keeping a fairly stable sell signal (located below the signal line). Stochastic has reversed downwards near its highs and is currently signaling a fairly strong "bearish" sentiment in the ultra-short term.

One should keep existing short positions and open new ones in the short and/or ultra-short term.

Resistance levels: 15.84, 16.00, 16.16, 16.28.

Support levels: 15.75, 15.66, 15.58, 15.47.

Trading tips

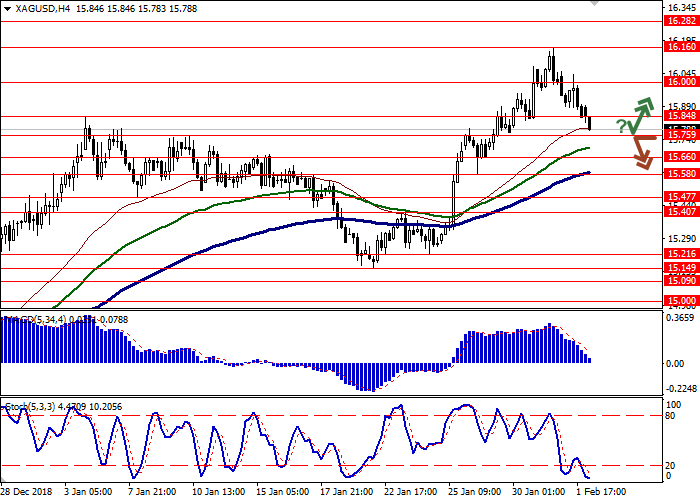

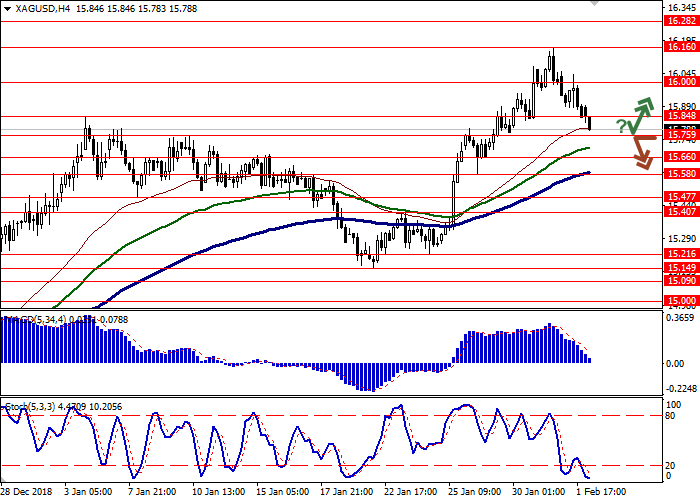

To open long positions, one can rely on the rebound from the support level of 15.75 with the subsequent breakout of 15.84. Take profit — 16.00 or 16.10, 16.16. Stop loss — 15.75. Implementation period: 2-3 days.

A breakdown of 15.75 may become a signal to further sales with target at 15.66 or 15.58. Stop loss — 15.84. Implementation period: 1-2 days.

Silver prices dropped significantly on Friday, continuing the development of the "bearish" impetus formed the day before. Negative trend was facilitated by the release of the labor market report and of the data on business activity in the United States.

Nonfarm Payrolls rose from 222K to 304K, with the expected decline to 165K. At the same time, the Unemployment Rate in January unexpectedly rose from 3.9% to 4.0%, while the Average Hourly Earnings grew by only 0.1% MoM with an expected growth of 0.3% MoM.

In turn, Markit Manufacturing PMI in January remained at the same level of 54.9 points. ISM Manufacturing PMI jumped from 54.3 to 56.6 points with the expected decline to 54.2 points.

Support and resistance

In the D1 chart, Bollinger Bands are reversing horizontally. The price range is actively expanding from above almost not reacting to the appearance of a steady "bearish" trend. MACD is going down keeping a fairly stable sell signal (located below the signal line). Stochastic has reversed downwards near its highs and is currently signaling a fairly strong "bearish" sentiment in the ultra-short term.

One should keep existing short positions and open new ones in the short and/or ultra-short term.

Resistance levels: 15.84, 16.00, 16.16, 16.28.

Support levels: 15.75, 15.66, 15.58, 15.47.

Trading tips

To open long positions, one can rely on the rebound from the support level of 15.75 with the subsequent breakout of 15.84. Take profit — 16.00 or 16.10, 16.16. Stop loss — 15.75. Implementation period: 2-3 days.

A breakdown of 15.75 may become a signal to further sales with target at 15.66 or 15.58. Stop loss — 15.84. Implementation period: 1-2 days.

No comments:

Write comments