AUD/USD: the pair is trading in the narrow range

10 November 2017, 08:54

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 0.7710 |

| Take Profit | 0.7750, 0.7775 |

| Stop Loss | 0.7670 |

| Key Levels | 0.7600, 0.7623, 0.7636, 0.7664, 0.7700, 0.7717, 0.7731, 0.7769 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL LIMIT |

| Entry Point | 0.7700 |

| Take Profit | 0.7636, 0.7623 |

| Stop Loss | 0.7730 |

| Key Levels | 0.7600, 0.7623, 0.7636, 0.7664, 0.7700, 0.7717, 0.7731, 0.7769 |

Current trend

Today Australian dollar is neutral against the US currency and continues to develop flat dynamics in the short term. Pressure on the instrument was put by RBA comments on the monetary policy but later AUD managed to restore in view of quite weak positions of USD.

RBA pointed out that basic inflation would not reach the target level of 2% until 2019, though before they expected it to make 2.5% by the beginning of 2019. The regulator confirmed it would not increase the interest rate in the near future which put pressure on the positions of the Australian currency.

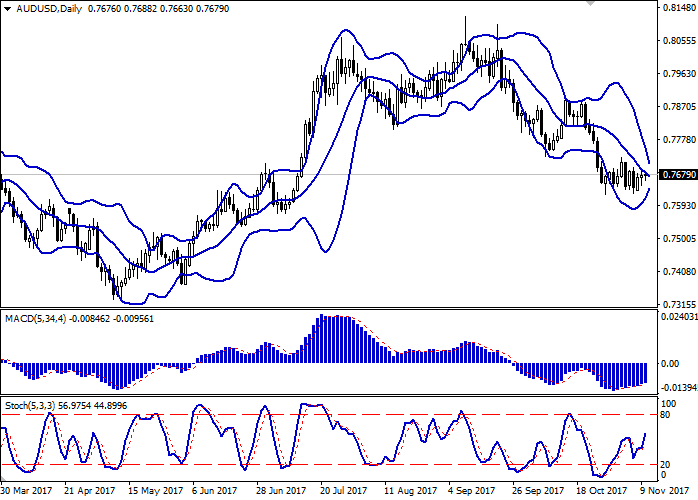

Support and resistance

Bollinger Bands in D1 chart show moderate reduction. The price range is actively widening. MACD indicator is growing preserving a quite stable buy signal (the histogram is above the signal line). Stochastic is showing similar dynamics quickly strengthening after a fall at the beginning of the week.

Resistance levels: 0.7700, 0.7717, 0.7731, 0.7769.

Support levels: 0.7664, 0.7636, 0.7623, 0.7600.

Trading tips

Long positions may be opened after breaking through the level of 0.7700 with targets at 0.7750, 0.7775 and stop-loss at 0.7670. The period of implementation is 2-3 days.

Moving away from 0.7700 as a resistance level will be a signal for the return of the downward dynamics with targets at 0.7636, 0.7623 and stop-loss at 0.7730. The period of implementation is 2-3 days.

Today Australian dollar is neutral against the US currency and continues to develop flat dynamics in the short term. Pressure on the instrument was put by RBA comments on the monetary policy but later AUD managed to restore in view of quite weak positions of USD.

RBA pointed out that basic inflation would not reach the target level of 2% until 2019, though before they expected it to make 2.5% by the beginning of 2019. The regulator confirmed it would not increase the interest rate in the near future which put pressure on the positions of the Australian currency.

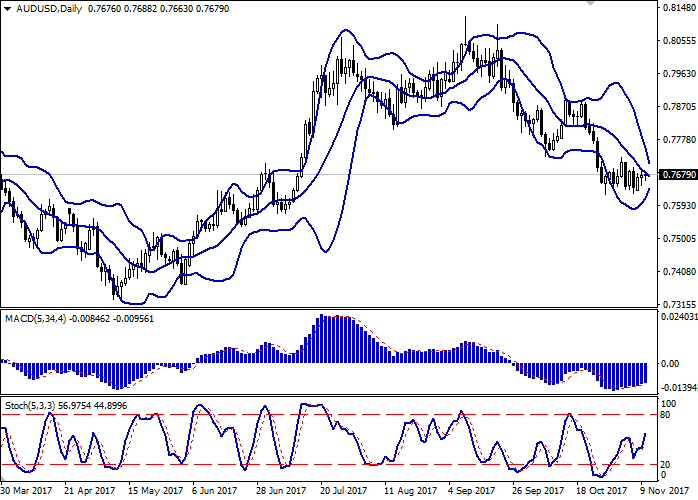

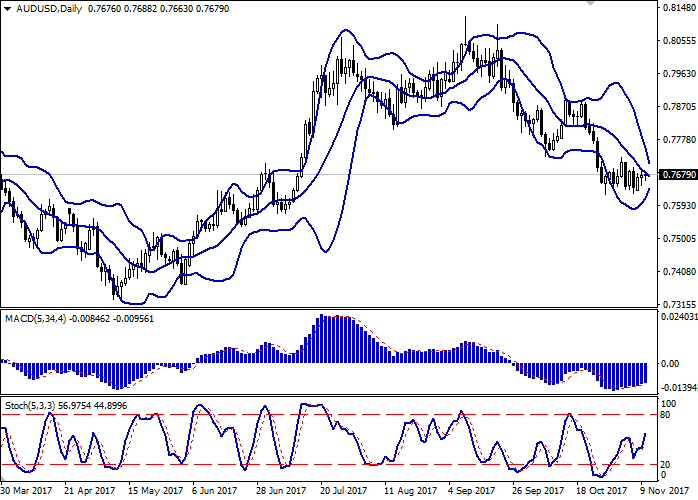

Support and resistance

Bollinger Bands in D1 chart show moderate reduction. The price range is actively widening. MACD indicator is growing preserving a quite stable buy signal (the histogram is above the signal line). Stochastic is showing similar dynamics quickly strengthening after a fall at the beginning of the week.

Resistance levels: 0.7700, 0.7717, 0.7731, 0.7769.

Support levels: 0.7664, 0.7636, 0.7623, 0.7600.

Trading tips

Long positions may be opened after breaking through the level of 0.7700 with targets at 0.7750, 0.7775 and stop-loss at 0.7670. The period of implementation is 2-3 days.

Moving away from 0.7700 as a resistance level will be a signal for the return of the downward dynamics with targets at 0.7636, 0.7623 and stop-loss at 0.7730. The period of implementation is 2-3 days.

No comments:

Write comments