USD/JPY: the US dollar is dropping

01 February 2019, 08:36

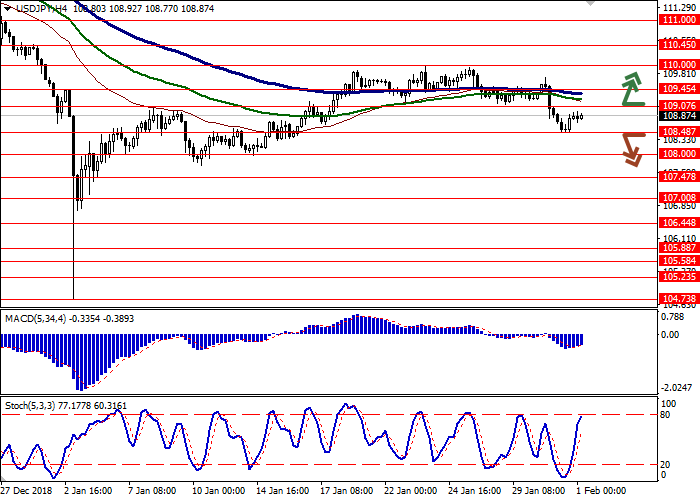

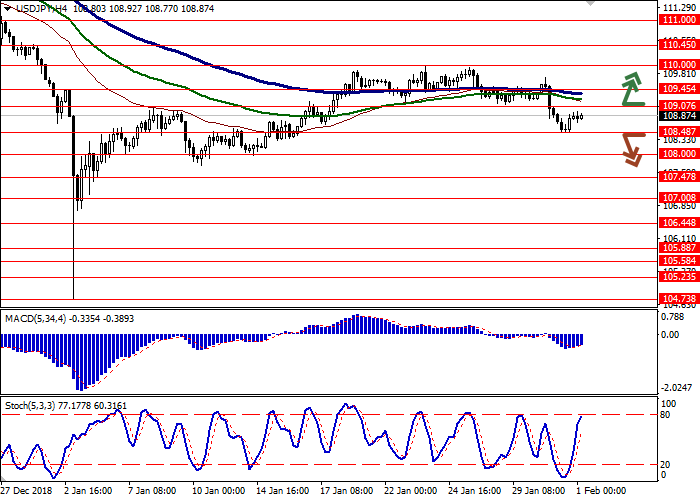

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 109.10 |

| Take Profit | 110.00, 110.45 |

| Stop Loss | 108.60, 108.50 |

| Key Levels | 107.00, 107.47, 108.00, 108.48, 109.07, 109.45, 110.00, 110.45 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 108.40 |

| Take Profit | 107.47, 107.00 |

| Stop Loss | 109.00 |

| Key Levels | 107.00, 107.47, 108.00, 108.48, 109.07, 109.45, 110.00, 110.45 |

Current trend

USD showed a moderate decrease against JPY on Thursday, updating the local lows of January 16. However, closer to the end of the day, the instrument managed to regain most of the losses, receiving support from strong macroeconomic statistics on the dynamics of new home sales in the US.

JPY is supported by positive statistics from China and data on industrial production in Japan. In January, Manufacturing PMI of China grew for the first time in five months and amounted to 49.5 points. Non-Manufacturing PMI increased for the second month in a row, this time from 53.8 to 54.7 points. In December, industrial production in Japan decreased by 0.1%, which is much less than the forecast of –0.5% and the November figure of –1.0%.

Today, JPY receives little support from Japanese statistics. The unemployment rate in Japan in December fell from 2.5% to 2.4%, as expected.

Support and resistance

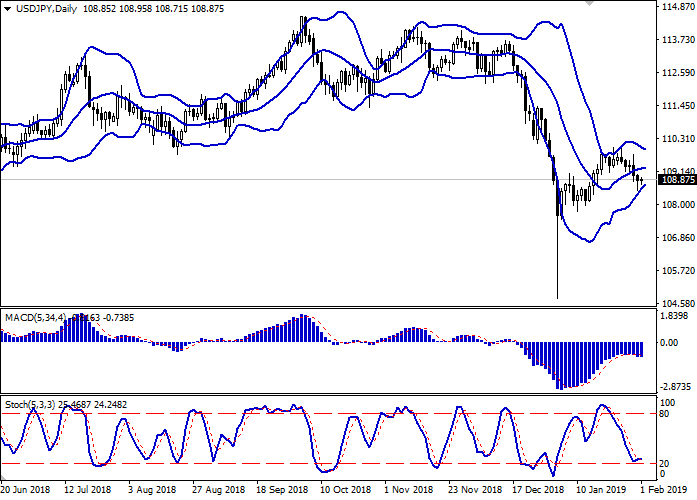

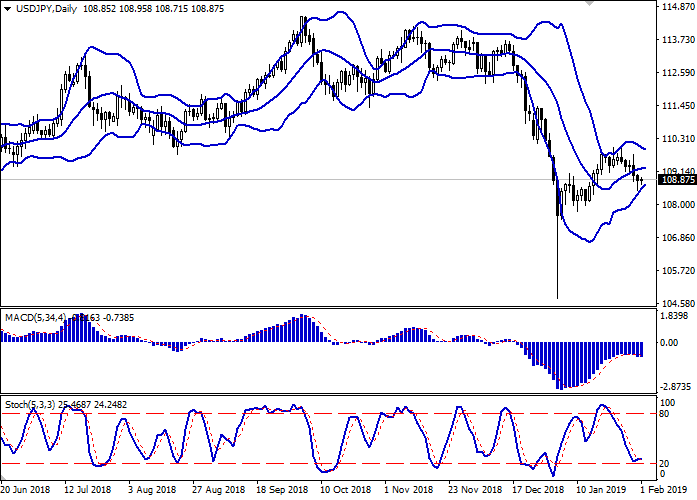

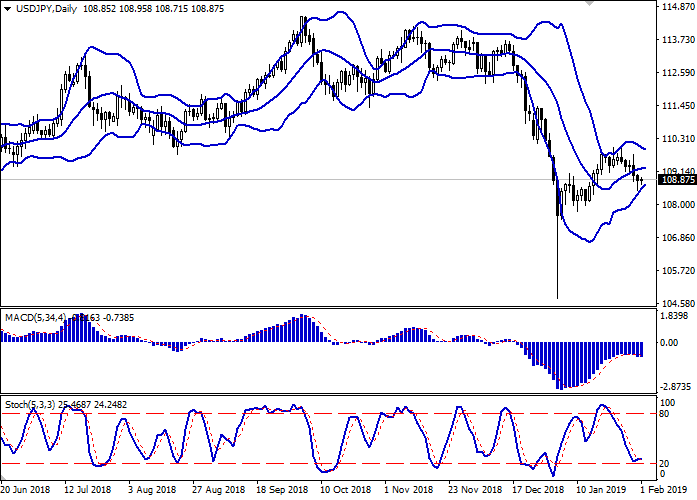

On the D1 chart, Bollinger Bands are gradually reversing horizontally. The price range is narrowing, reflecting the development of "bearish" trend in the short term. MACD is declining keeping a weak sell signal (located below the signal line). Stochastic approaching its lows is trying to reverse upwards, indicating the risks of the appearance of correctional dynamics.

It is necessary to wait for clarification of the situation in the market to open new positions.

Resistance levels: 109.07, 109.45, 110.00, 110.45.

Support levels: 108.48, 108.00, 107.47, 107.00.

Trading tips

To open long positions, one can rely on the breakout of 109.07. Take profit — 110.00 or 110.45. Stop loss — 108.60 or 108.50.

The return of "bearish" trend with the breakdown of 108.48 may become a signal for further sales with the target at 107.47 or 107.00. Stop loss — 109.00.

Implementation period: 2-3 days.

USD showed a moderate decrease against JPY on Thursday, updating the local lows of January 16. However, closer to the end of the day, the instrument managed to regain most of the losses, receiving support from strong macroeconomic statistics on the dynamics of new home sales in the US.

JPY is supported by positive statistics from China and data on industrial production in Japan. In January, Manufacturing PMI of China grew for the first time in five months and amounted to 49.5 points. Non-Manufacturing PMI increased for the second month in a row, this time from 53.8 to 54.7 points. In December, industrial production in Japan decreased by 0.1%, which is much less than the forecast of –0.5% and the November figure of –1.0%.

Today, JPY receives little support from Japanese statistics. The unemployment rate in Japan in December fell from 2.5% to 2.4%, as expected.

Support and resistance

On the D1 chart, Bollinger Bands are gradually reversing horizontally. The price range is narrowing, reflecting the development of "bearish" trend in the short term. MACD is declining keeping a weak sell signal (located below the signal line). Stochastic approaching its lows is trying to reverse upwards, indicating the risks of the appearance of correctional dynamics.

It is necessary to wait for clarification of the situation in the market to open new positions.

Resistance levels: 109.07, 109.45, 110.00, 110.45.

Support levels: 108.48, 108.00, 107.47, 107.00.

Trading tips

To open long positions, one can rely on the breakout of 109.07. Take profit — 110.00 or 110.45. Stop loss — 108.60 or 108.50.

The return of "bearish" trend with the breakdown of 108.48 may become a signal for further sales with the target at 107.47 or 107.00. Stop loss — 109.00.

Implementation period: 2-3 days.

No comments:

Write comments