USD/CHF: wave analysis

20 July 2022, 10:52

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY |

| Entry Point | 0.9685 |

| Take Profit | 1.0200, 1.0350 |

| Stop Loss | 0.9490 |

| Key Levels | 0.9186, 0.9319, 0.9490, 1.0200, 1.0350 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 0.9485 |

| Take Profit | 0.9319, 0.9186 |

| Stop Loss | 0.9545 |

| Key Levels | 0.9186, 0.9319, 0.9490, 1.0200, 1.0350 |

The possibility of growth remains.

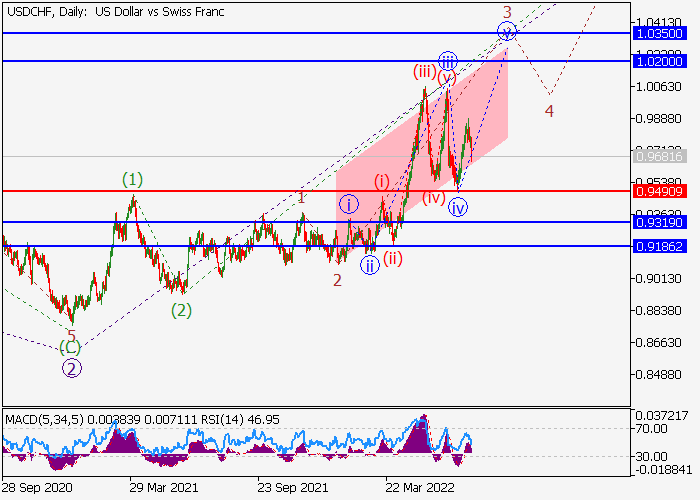

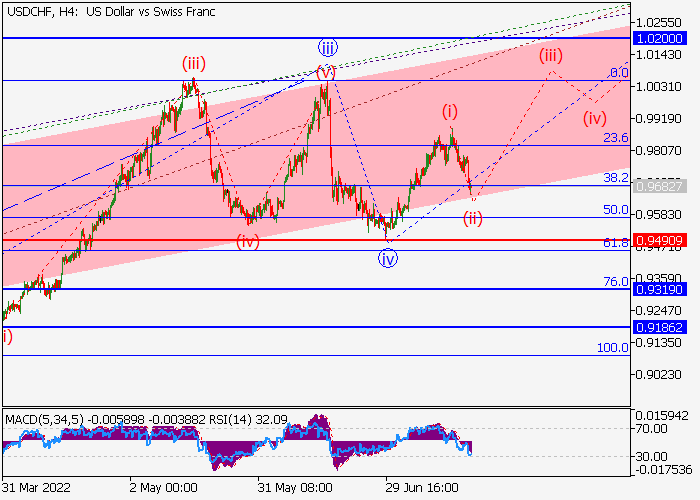

On the daily chart, the development of the third wave of the higher level 3 of (3) continues, in which wave iii of 3 formed and the correction ended as the fourth wave iv of 3. At the moment, the construction of the fifth wave v of 3 is underway, in which the first wave of the lower level (i) of v has already appeared, and the development of a local correction as a wave (ii) of v is also being completed. If the assumption is correct, USD/CHF will rise to the levels of 1.0200–1.0350. The level of 0.9490 is critical and stop-loss for this scenario.

Main scenario

Long positions are relevant from the corrections above level of 0.9490 with targets at 1.0200–1.0350. Implementation time: 7 days and more.

Alternative scenario

Breakdown and consolidation of the price below the level of 0.9490 will allow the trading instrument to continue its downtrend to the levels of 0.9319–0.9186.

No comments:

Write comments