EUR/JPY: Ichimoku clouds

04 February 2019, 05:38

| Scenario | |

|---|---|

| Timeframe | Weekly |

| Recommendation | BUY STOP |

| Entry Point | 125.80 |

| Take Profit | 126.85 |

| Stop Loss | 125.35 |

| Key Levels | 124.07, 124.50, 124.75, 125.07, 125.33, 125.73, 126.18, 126.98. |

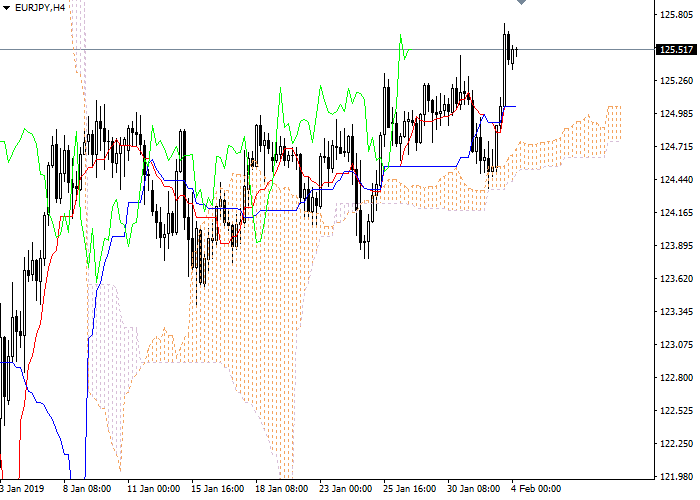

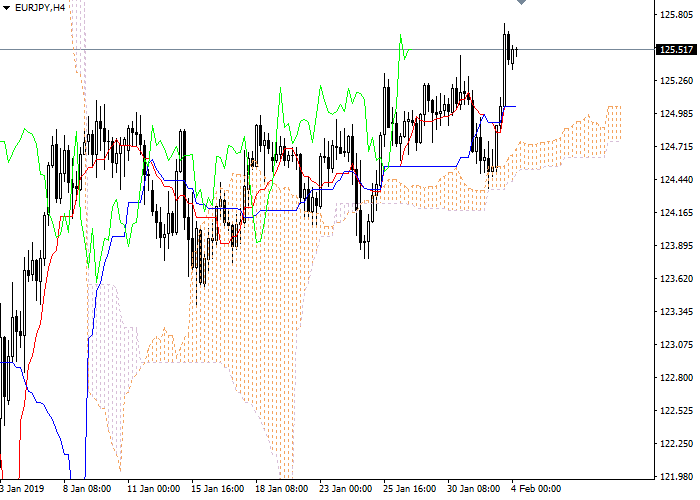

Let's look at the four-hour chart. Tenkan-sen line is crossing Kijun-sen from below, the red line is directed upwards, while the blue one remains horizontal. Confirmative line Chikou Span is above the price chart, current cloud is ascending. The instrument is trading above Tenkan-sen and Kijun-sen lines; the Bullish trend is still strong. The closest support level is the upper border of the cloud (125.04). One of the previous maximums of Chikou Span line is expected to be a resistance level (125.64).

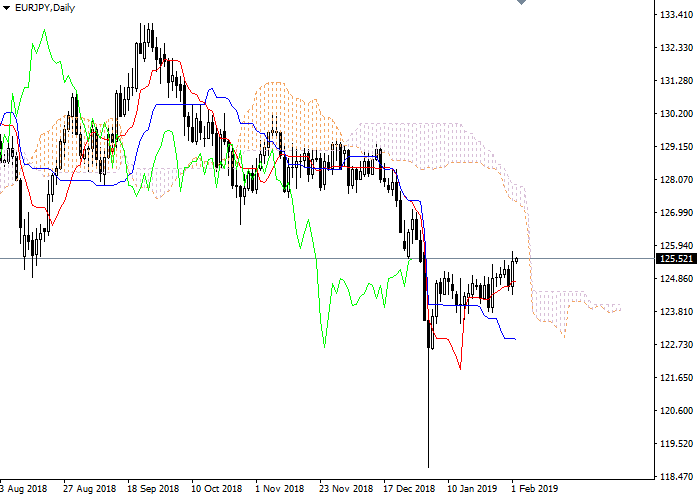

On the daily chart Tenkan-sen line has crossed Kijun-sen from below, the lines are horizontal . Confirmative line Chikou Span is approaching the price chart from below, current cloud is descending. The instrument is trading above Tenkan-sen and Kijun-sen lines; the Bullish trend is still strong. The closest support level is Tenkan-sen line (124.75). One of the previous maximums of Chikou Span line is expected to be a resistance level (125.82).

On the four-hour chart we can see a correction of the upward movement. On the daily chart the Bullish trend is still strong. Long trades can be opened as soon as we get a confirmative signal from Chikou Span line (the line should cross the price chart). Presumable entry point is 125.80, Take Profit – 126.85, Stop Loss – 125.35.

No comments:

Write comments