AUD/USD: Australian dollar is strengthening

01 February 2019, 09:39

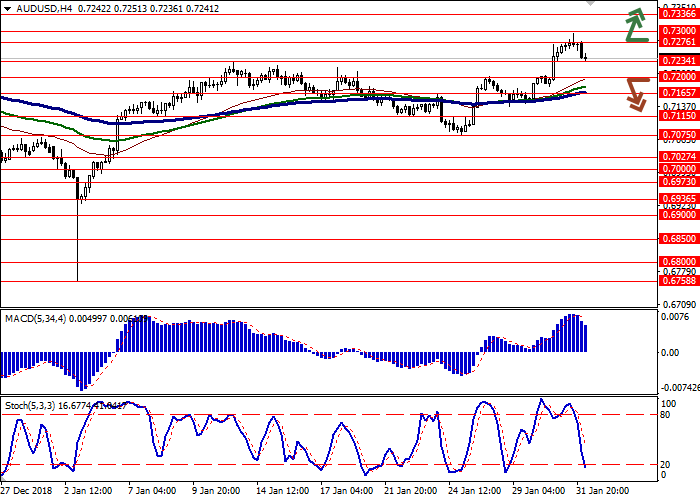

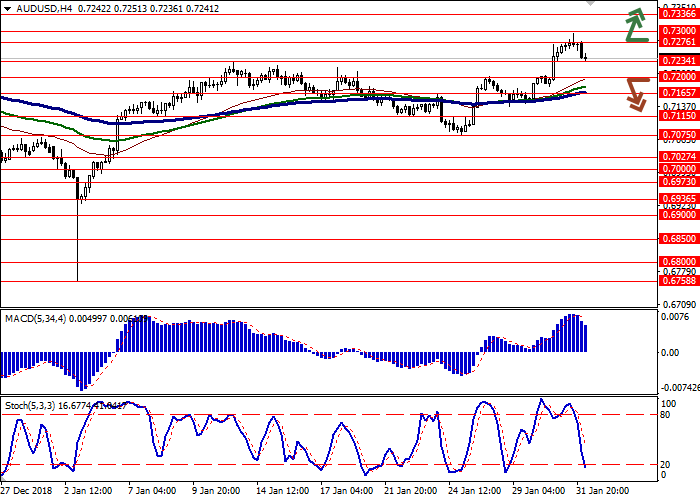

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 0.7280, 0.7305 |

| Take Profit | 0.7336, 0.7360 |

| Stop Loss | 0.7250, 0.7230 |

| Key Levels | 0.7115, 0.7165, 0.7200, 0.7234, 0.7276, 0.7300, 0.7336 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 0.7195 |

| Take Profit | 0.7115, 0.7075 |

| Stop Loss | 0.7240, 0.7250 |

| Key Levels | 0.7115, 0.7165, 0.7200, 0.7234, 0.7276, 0.7300, 0.7336 |

Current trend

AUD showed moderate growth on Thursday, updating local highs of December 5, 2018.

The growth of AUD was facilitated by the positive data on the Chinese Manufacturing and Non-Manufacturing PMI, as well as hints that the US Federal Reserve will suspend monetary policy tightening. However, with the release of a strong statistics on new home sales in the US on Thursday, the instrument has noticeably corrected. In November, home sales rose by 16.9% against a decline of 8.3% in October. In absolute terms, sales increased from 0.562M to 0.657M homes.

Today, the instrument shows a corrective decline. Despite the publication of a strong AIG Manufacturing Index of Australia (52.5 points in January against 49.5 in the previous month), investors concentrated on weak data on the Producer Price Index. In Q4 2018 the indicator rose by 0.5% QoQ only, after the increase by 0.8% QoQ in the previous period.

Support and resistance

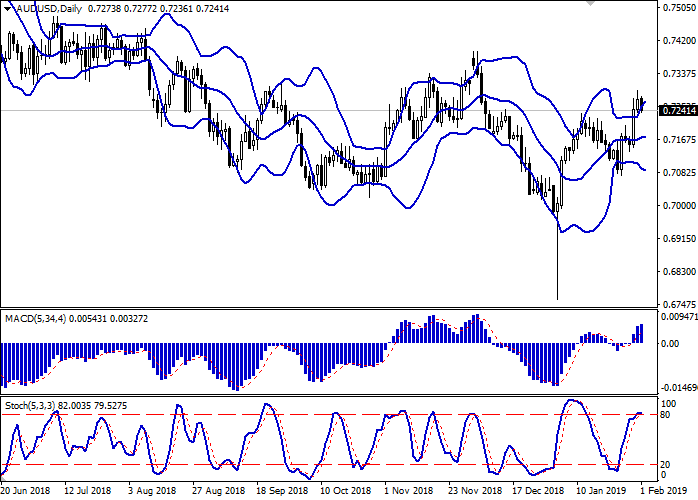

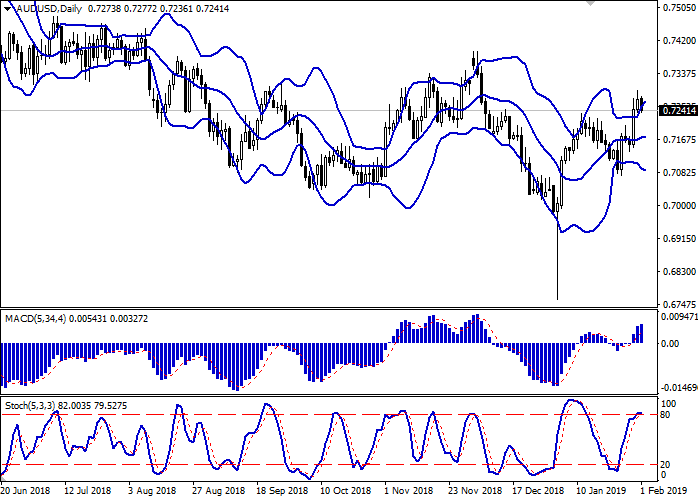

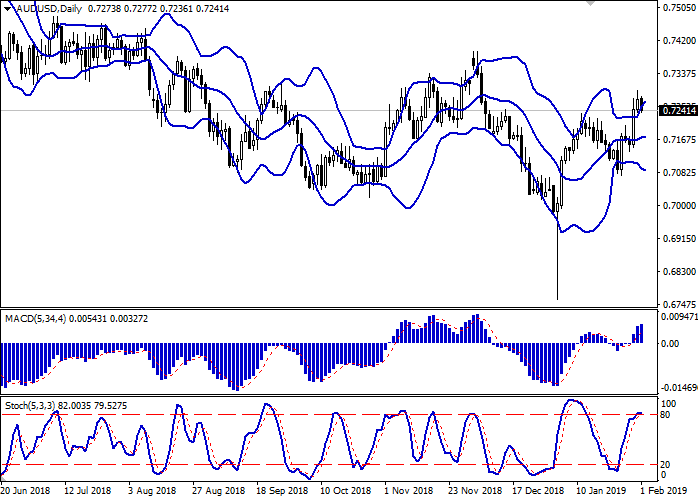

Bollinger Bands in the D1 chart demonstrate flat dynamics. The price range is expanding but it fails to catch the development of "bullish" trend at the moment. MACD indicator is growing, keeping a stable buy signal (located above the signal line). Stochastic, having reached the "80" level, is reversing into the horizontal plane, indicating growing risks of correctional decline in the short and/or ultra-short term.

The "bearish" trend may develop in the near future.

Resistance levels: 0.7276, 0.7300, 0.7336.

Support levels: 0.7234, 0.7200, 0.7165, 0.7115.

Trading tips

To open long positions, one can rely on the breakout of 0.7276 or 0.7300. Take profit — 0.7336 or 0.7360. Stop loss — 0.7250 or 0.7230.

A breakdown of 0.7200 may be a signal for correctional sales with target at 0.7115 or 0.7075. Stop loss — 0.7240 or 0.7250.

Implementation period: 2-3 days.

AUD showed moderate growth on Thursday, updating local highs of December 5, 2018.

The growth of AUD was facilitated by the positive data on the Chinese Manufacturing and Non-Manufacturing PMI, as well as hints that the US Federal Reserve will suspend monetary policy tightening. However, with the release of a strong statistics on new home sales in the US on Thursday, the instrument has noticeably corrected. In November, home sales rose by 16.9% against a decline of 8.3% in October. In absolute terms, sales increased from 0.562M to 0.657M homes.

Today, the instrument shows a corrective decline. Despite the publication of a strong AIG Manufacturing Index of Australia (52.5 points in January against 49.5 in the previous month), investors concentrated on weak data on the Producer Price Index. In Q4 2018 the indicator rose by 0.5% QoQ only, after the increase by 0.8% QoQ in the previous period.

Support and resistance

Bollinger Bands in the D1 chart demonstrate flat dynamics. The price range is expanding but it fails to catch the development of "bullish" trend at the moment. MACD indicator is growing, keeping a stable buy signal (located above the signal line). Stochastic, having reached the "80" level, is reversing into the horizontal plane, indicating growing risks of correctional decline in the short and/or ultra-short term.

The "bearish" trend may develop in the near future.

Resistance levels: 0.7276, 0.7300, 0.7336.

Support levels: 0.7234, 0.7200, 0.7165, 0.7115.

Trading tips

To open long positions, one can rely on the breakout of 0.7276 or 0.7300. Take profit — 0.7336 or 0.7360. Stop loss — 0.7250 or 0.7230.

A breakdown of 0.7200 may be a signal for correctional sales with target at 0.7115 or 0.7075. Stop loss — 0.7240 or 0.7250.

Implementation period: 2-3 days.

No comments:

Write comments