YM: general review

10 November 2017, 09:31

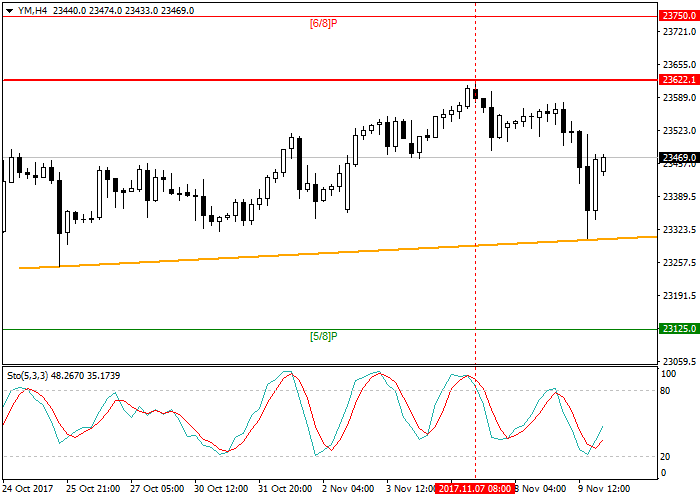

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | SELL STOP |

| Entry Point | 23304.0 |

| Take Profit | 23125.0 |

| Stop Loss | 23622.1 |

| Key Levels | 23125.0, 23304.6, 23622.1, 23750.0 |

Current trend

Dow Jones index was slightly corrected from absolute maximums and is now trading at the level of 23460.0. The nearest important support level is at 23304.6. If the price breaks it down, the next target will be 23125.0 or 5/8 Murrey.

The wave of sales in the US stock market is caused by uncertainty around Trump’s tax budget. According to the US Congress that is in charge of the national budget, if the tax benefits program is passed, this would increase the budget for the next decade by almost $1.7 trln. Therefore it may be not passed by the Senate as is and may require considerable transformation leading to additional disappointment among investors and further market decline.

The second negative factor was today’s economic statistics. The number of initial jobless claims in the USA reached 239K against the forecast of 232K. Economists say this is just a slight correction as the economy continues to grow and the level of employment would increase having a positive impact on demand among average citizens and American corporations.

Special attention today should be pair to consumer trust index by Reuters/Michigan (initial data for November).

Support and resistance

Stochastic is at 48 points and does not give any signals for opening transactions.

Resistance levels: 23622.1, 23750.0.

Support levels: 23304.6, 23125.0.

Trading tips

Short positions may be opened if the price breaks through the support level of 23304.6 with target at 23125.0 and stop-loss at 23622.1.

Dow Jones index was slightly corrected from absolute maximums and is now trading at the level of 23460.0. The nearest important support level is at 23304.6. If the price breaks it down, the next target will be 23125.0 or 5/8 Murrey.

The wave of sales in the US stock market is caused by uncertainty around Trump’s tax budget. According to the US Congress that is in charge of the national budget, if the tax benefits program is passed, this would increase the budget for the next decade by almost $1.7 trln. Therefore it may be not passed by the Senate as is and may require considerable transformation leading to additional disappointment among investors and further market decline.

The second negative factor was today’s economic statistics. The number of initial jobless claims in the USA reached 239K against the forecast of 232K. Economists say this is just a slight correction as the economy continues to grow and the level of employment would increase having a positive impact on demand among average citizens and American corporations.

Special attention today should be pair to consumer trust index by Reuters/Michigan (initial data for November).

Support and resistance

Stochastic is at 48 points and does not give any signals for opening transactions.

Resistance levels: 23622.1, 23750.0.

Support levels: 23304.6, 23125.0.

Trading tips

Short positions may be opened if the price breaks through the support level of 23304.6 with target at 23125.0 and stop-loss at 23622.1.

No comments:

Write comments