XAU/USD: general analysis

09 November 2017, 12:26

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | SELL STOP |

| Entry Point | 1277.45 |

| Take Profit | 1274.50, 1271.00 |

| Stop Loss | 1281.00 |

| Key Levels | 1254.50, 1262.90, 1269.80, 1275.45, 1279.50, 1283.00, 1290.80, 1297.00, 1303.95, 1309.25 |

| Alternative scenario | |

|---|---|

| Recommendation | BUY STOP |

| Entry Point | 1285.10 |

| Take Profit | 1297.25 |

| Stop Loss | 1276.90 |

| Key Levels | 1254.50, 1262.90, 1269.80, 1275.45, 1279.50, 1283.00, 1290.80, 1297.00, 1303.95, 1309.25 |

Current trend

The pair XAU/USD is strengthening after Paul Ryan’s speech in the US House of Representatives. Speaker considers it dangerous for the country's economy to introduce a new tax code so quickly. The delay in the adoption of tax reform can make significant changes to the Fed's monetary policy plans for 2018. At the same time, the growth of yield on government bonds did not allow the pair to gain a foothold above the level of 1285.00.

At the moment, traders are closely watching developments around the tax reform. A further delay in this matter will help strengthen XAU/USD. In addition, since gold is considered a safe asset, investor interest is supported by news from the Korean peninsula.

Today, strong data on unemployment claims in US may contribute to the fall of XAU/USD to the level of 1275.00-1274.00. In addition, the pressure on the pair will have the expected growth in commodity stocks at wholesale warehouses in the US, as well as an increase in the yield of government bonds.

Support and resistance

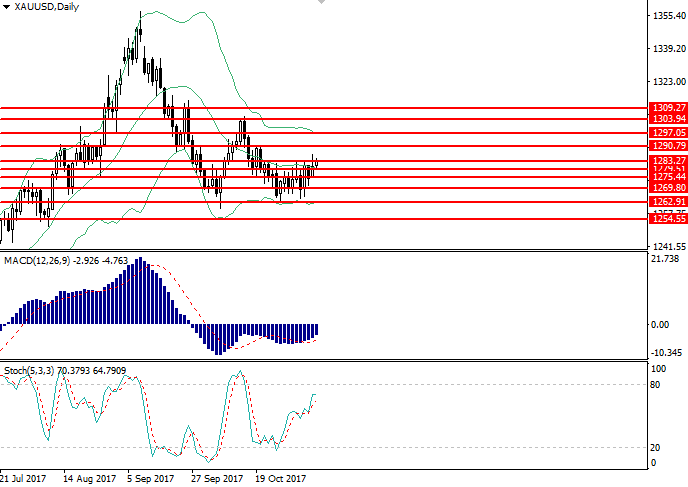

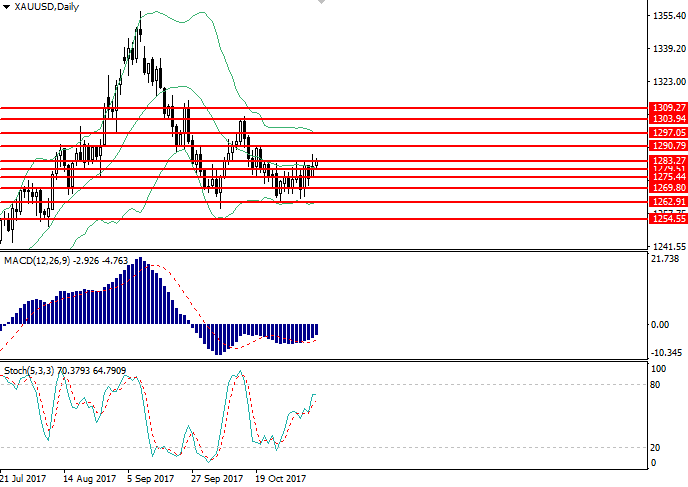

On the daily chart, the price is testing the resistance level of 1283.00. Bollinger bands are turned sideways, while the price range is narrowing, indicating a high probability of trend reversal. The MACD histogram is in the negative zone, keeping the signal for sale. Stochastic does not give clear signals.

Support levels: 1254.50, 1262.90, 1269.80, 1275.45, 1279.50.

Resistance levels: 1283.00, 1290.80, 1297.00, 1303.95, 1309.25.

Trading tips

Short positions can be opened at the level of 1277.45 with targets of 1274.50, 1271.00 and stop loss at 1281.00. Term of realization: 1-2 days.

Long positions should be opened above the level of 1285.00 with a target of 1297.25 and a stop loss at the level of 1276.90. Implementation period: 1-3 days.

The pair XAU/USD is strengthening after Paul Ryan’s speech in the US House of Representatives. Speaker considers it dangerous for the country's economy to introduce a new tax code so quickly. The delay in the adoption of tax reform can make significant changes to the Fed's monetary policy plans for 2018. At the same time, the growth of yield on government bonds did not allow the pair to gain a foothold above the level of 1285.00.

At the moment, traders are closely watching developments around the tax reform. A further delay in this matter will help strengthen XAU/USD. In addition, since gold is considered a safe asset, investor interest is supported by news from the Korean peninsula.

Today, strong data on unemployment claims in US may contribute to the fall of XAU/USD to the level of 1275.00-1274.00. In addition, the pressure on the pair will have the expected growth in commodity stocks at wholesale warehouses in the US, as well as an increase in the yield of government bonds.

Support and resistance

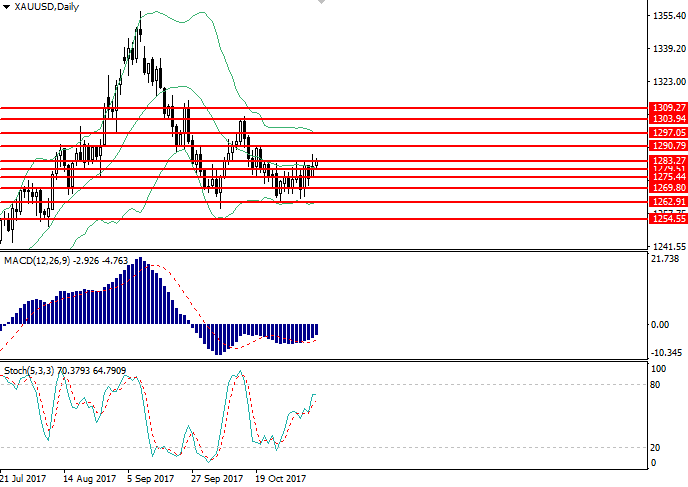

On the daily chart, the price is testing the resistance level of 1283.00. Bollinger bands are turned sideways, while the price range is narrowing, indicating a high probability of trend reversal. The MACD histogram is in the negative zone, keeping the signal for sale. Stochastic does not give clear signals.

Support levels: 1254.50, 1262.90, 1269.80, 1275.45, 1279.50.

Resistance levels: 1283.00, 1290.80, 1297.00, 1303.95, 1309.25.

Trading tips

Short positions can be opened at the level of 1277.45 with targets of 1274.50, 1271.00 and stop loss at 1281.00. Term of realization: 1-2 days.

Long positions should be opened above the level of 1285.00 with a target of 1297.25 and a stop loss at the level of 1276.90. Implementation period: 1-3 days.