AUD/USD: Australian dollar is correcting

09 August 2019, 09:59

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 0.6835 |

| Take Profit | 0.6933, 0.6955 |

| Stop Loss | 0.6780 |

| Key Levels | 0.6675, 0.6700, 0.6747, 0.6800, 0.6830, 0.6860, 0.6883, 0.6900 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 0.6795 |

| Take Profit | 0.6700, 0.6675 |

| Stop Loss | 0.6840, 0.6850 |

| Key Levels | 0.6675, 0.6700, 0.6747, 0.6800, 0.6830, 0.6860, 0.6883, 0.6900 |

Current trend

The Australian dollar rose significantly against the US currency on Thursday, continuing the development of the correctional impulse formed the day before. The instrument was supported by Chinese trade statistics, which, despite the continuing tensions between the US and China, showed an increase in July.

Today, the pair is trading in both directions. Investors are focused on the speech of the RBA Governor Philip Lowe and the comments of the Australian regulator on monetary policy. No concrete hints were expected from Lowe's speech on further easing of monetary policy, so the reaction of the market to it was very restrained. The head of the RBA noted the insufficiently rapid increase in inflation in the country, as well as the growth of external economic risks, primarily due to the deterioration of trade relations between China and the United States.

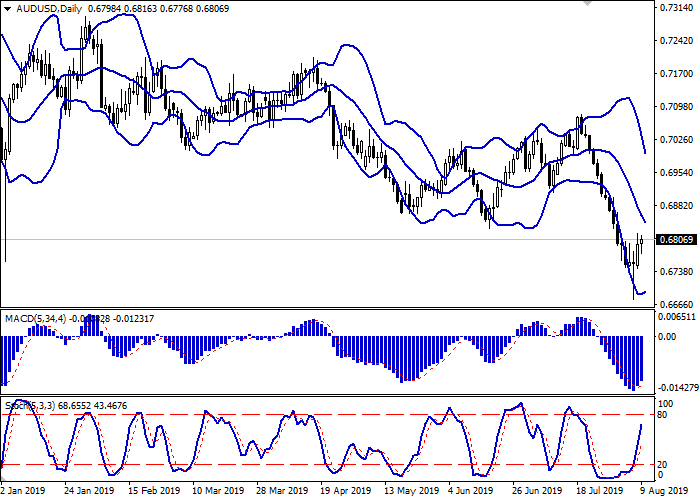

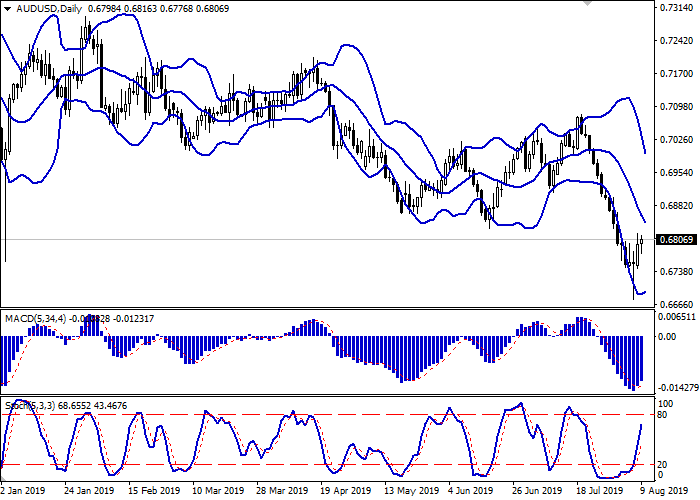

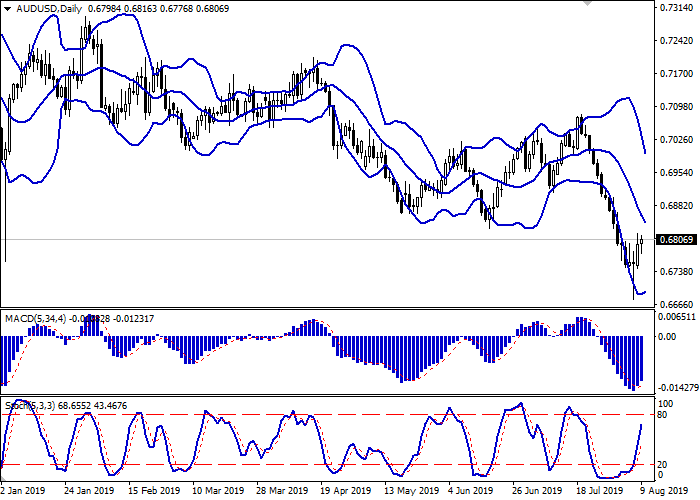

Support and resistance

Bollinger Bands in D1 chart demonstrate a stable decrease. The price range is narrowing, reflecting the correctional trend formation in the short term. MACD has reversed to growth having formed a strong buy signal (located above the signal line). Stochastic keeps its upward direction but is approaching its highs rapidly, which reflects risks of the overbought instrument in the ultra-short term.

Existing long positions should be kept until the situation clears up.

Resistance levels: 0.6830, 0.6860, 0.6883, 0.6900.

Support levels: 0.6800, 0.6747, 0.6700, 0.6675.

Trading tips

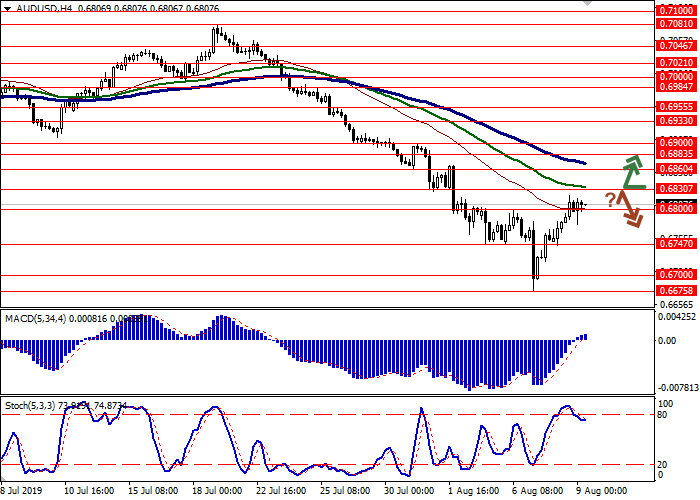

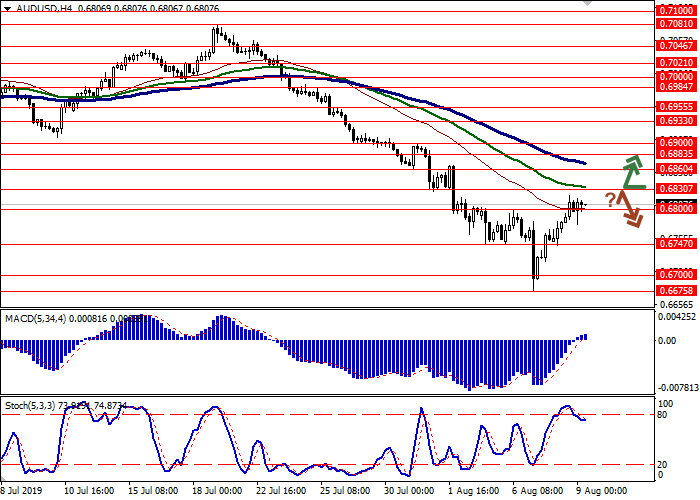

To open long positions, one can rely on the breakout of 0.6830. Take profit — 0.6933 or 0.6955. Stop loss — 0.6780.

The rebound from 0.6830 as from resistance with the subsequent breakdown of 0.6800 can become a signal to new sales with target at 0.6700 or 0.6675. Stop loss — 0.6840–0.6850.

Implementation time: 2-3 days.

The Australian dollar rose significantly against the US currency on Thursday, continuing the development of the correctional impulse formed the day before. The instrument was supported by Chinese trade statistics, which, despite the continuing tensions between the US and China, showed an increase in July.

Today, the pair is trading in both directions. Investors are focused on the speech of the RBA Governor Philip Lowe and the comments of the Australian regulator on monetary policy. No concrete hints were expected from Lowe's speech on further easing of monetary policy, so the reaction of the market to it was very restrained. The head of the RBA noted the insufficiently rapid increase in inflation in the country, as well as the growth of external economic risks, primarily due to the deterioration of trade relations between China and the United States.

Support and resistance

Bollinger Bands in D1 chart demonstrate a stable decrease. The price range is narrowing, reflecting the correctional trend formation in the short term. MACD has reversed to growth having formed a strong buy signal (located above the signal line). Stochastic keeps its upward direction but is approaching its highs rapidly, which reflects risks of the overbought instrument in the ultra-short term.

Existing long positions should be kept until the situation clears up.

Resistance levels: 0.6830, 0.6860, 0.6883, 0.6900.

Support levels: 0.6800, 0.6747, 0.6700, 0.6675.

Trading tips

To open long positions, one can rely on the breakout of 0.6830. Take profit — 0.6933 or 0.6955. Stop loss — 0.6780.

The rebound from 0.6830 as from resistance with the subsequent breakdown of 0.6800 can become a signal to new sales with target at 0.6700 or 0.6675. Stop loss — 0.6840–0.6850.

Implementation time: 2-3 days.

No comments:

Write comments