SPX: general review

10 January 2019, 08:29

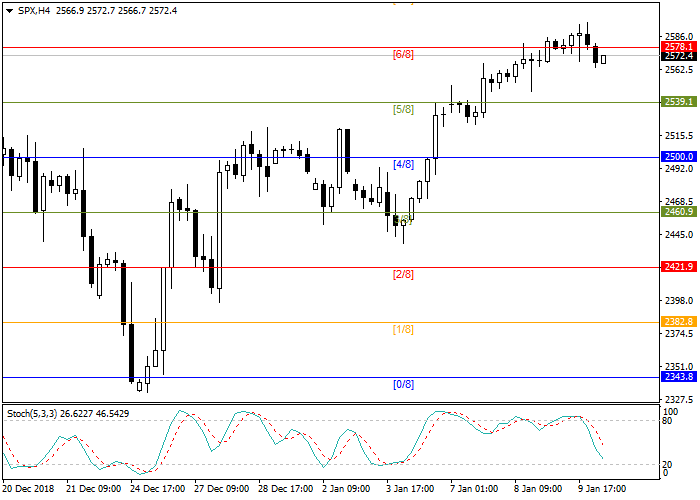

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 2595.0 |

| Take Profit | 2650.0 |

| Stop Loss | 2578.1 |

| Key Levels | 2500.0, 2539.1, 2578.1, 2617.2 |

Current trend

The S&P 500 is trading near the level of 2578.1 (Murrey [6/8]). If the asset can consolidate higher and break through the previous high, the next target will be the level of 2617.2.

A positive factor for the stock market is the trade negotiations between the United States and China, which lasted one day longer than planned, which caused optimism among the American leadership. Representatives of the White House, Finance Minister Steven Mnuchin and adviser Larry Kudlow are in favor of a quick agreement with China. As argument they used the volatility of the stock market, which sank significantly in December due to fear of escalating trade conflict between countries. It is also profitable for Beijing to conclude a trade agreement, as the US economy takes one of the leading places in the world in terms of consumption, while Chinese exports continue to grow, and losing such a huge market is not economically feasible. If by March the parties are unable to conclude a mutual trade agreement, then Washington can go for a further increase in protective duties.

Support and resistance

Stochastic is at 32 points and does not provide a signal for the opening of positions.

Resistance levels: 2578.1, 2617.2.

Support levels: 2539.1, 2500.0.

Trading tips

Open long positions after the breakout of 2594.6 with take profit at 2650.0 and stop loss at 2578.1.

The S&P 500 is trading near the level of 2578.1 (Murrey [6/8]). If the asset can consolidate higher and break through the previous high, the next target will be the level of 2617.2.

A positive factor for the stock market is the trade negotiations between the United States and China, which lasted one day longer than planned, which caused optimism among the American leadership. Representatives of the White House, Finance Minister Steven Mnuchin and adviser Larry Kudlow are in favor of a quick agreement with China. As argument they used the volatility of the stock market, which sank significantly in December due to fear of escalating trade conflict between countries. It is also profitable for Beijing to conclude a trade agreement, as the US economy takes one of the leading places in the world in terms of consumption, while Chinese exports continue to grow, and losing such a huge market is not economically feasible. If by March the parties are unable to conclude a mutual trade agreement, then Washington can go for a further increase in protective duties.

Support and resistance

Stochastic is at 32 points and does not provide a signal for the opening of positions.

Resistance levels: 2578.1, 2617.2.

Support levels: 2539.1, 2500.0.

Trading tips

Open long positions after the breakout of 2594.6 with take profit at 2650.0 and stop loss at 2578.1.

No comments:

Write comments