USD/CAD: Canadian dollar has grown

07 September 2017, 10:04

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY STOP |

| Entry Point | 1.2260 |

| Take Profit | 1.2360, 1.2400 |

| Stop Loss | 1.2190 |

| Key Levels | 1.2100, 1.2129, 1.2200, 1.2300, 1.2360, 1.2412, 1.2439, 1.2500 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 1.2180 |

| Take Profit | 1.2000 |

| Stop Loss | 1.2300 |

| Key Levels | 1.2100, 1.2129, 1.2200, 1.2300, 1.2360, 1.2412, 1.2439, 1.2500 |

Current trend

During trading session on Wednesday, September, 6, Canadian dollar rapidly grew against the US dollar, reaching the new maximum since June, 2015. Such steady “bullish” dynamics is due to surprising actions of the Bank of Canada, which has decided to increase the interest rate by 25 basis points to the level of 1.00%.

In the following commentary of the Bank is noted, that the decision upon the partially cutting the stimulation is due to good results of national economy, including the GDP report, which showed the growth of Canadian economy by 4.5% YoY from April to June.

Support and resistance

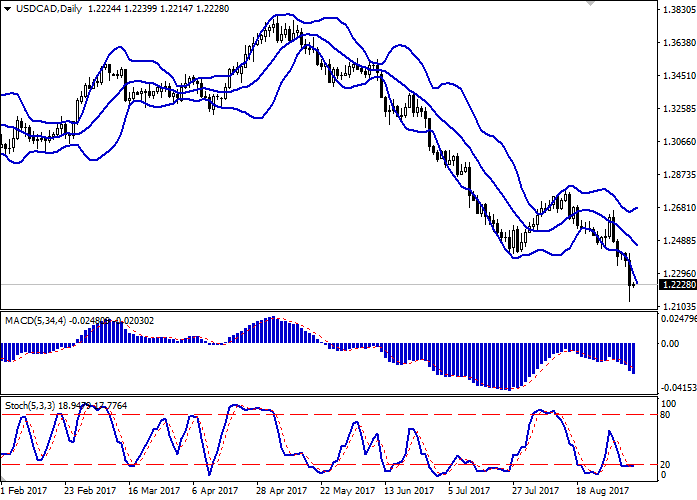

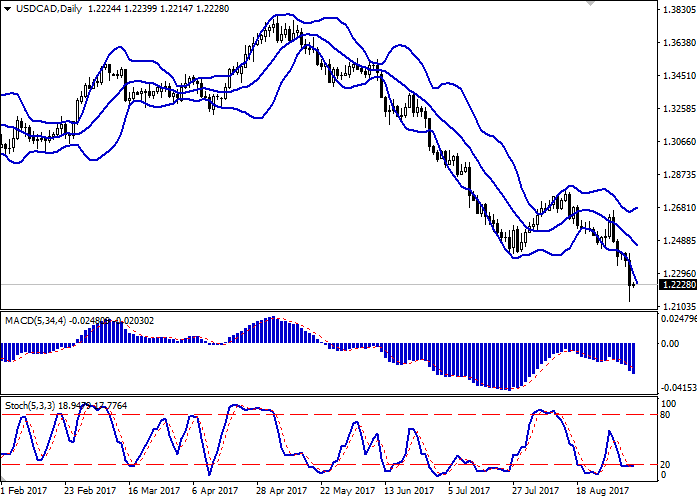

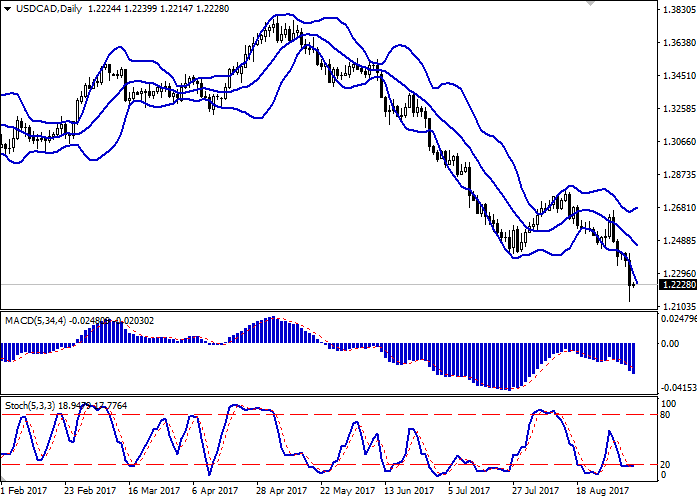

On the daily chart Bollinger Bands are steady falling. The price range is actively widening. The correction dynamics appearance of significant slowing of the current “bearish” trend is possible.

MACD is keeping steady downward trend. It’s better to keep opened short positions, but it’s wiser to wait before opening new ones.

Stochastic is around the border of the oversold area and is trying to reverse upwards, reflecting the possibility of correctional growth formation in the very short term.

Resistance levels: 1.2300, 1.2360, 1.2412, 1.2439, 1.2500.

Support levels: 1.2200, 1.2129, 1.2100.

Trading tips

Long positions can be opened after the reversal of the instrument around the level of 1.2200. Take profit is 1.2360 or 1.2400. Stop loss is 1.2190. Implementation period: 2 days.

The breakdown of the current support levels can be the signal to open short positions. The “bearish” targets will be the psychological level of 1.2000. Stop loss is 1.2300. Implementation period: 2-3 days.

During trading session on Wednesday, September, 6, Canadian dollar rapidly grew against the US dollar, reaching the new maximum since June, 2015. Such steady “bullish” dynamics is due to surprising actions of the Bank of Canada, which has decided to increase the interest rate by 25 basis points to the level of 1.00%.

In the following commentary of the Bank is noted, that the decision upon the partially cutting the stimulation is due to good results of national economy, including the GDP report, which showed the growth of Canadian economy by 4.5% YoY from April to June.

Support and resistance

On the daily chart Bollinger Bands are steady falling. The price range is actively widening. The correction dynamics appearance of significant slowing of the current “bearish” trend is possible.

MACD is keeping steady downward trend. It’s better to keep opened short positions, but it’s wiser to wait before opening new ones.

Stochastic is around the border of the oversold area and is trying to reverse upwards, reflecting the possibility of correctional growth formation in the very short term.

Resistance levels: 1.2300, 1.2360, 1.2412, 1.2439, 1.2500.

Support levels: 1.2200, 1.2129, 1.2100.

Trading tips

Long positions can be opened after the reversal of the instrument around the level of 1.2200. Take profit is 1.2360 or 1.2400. Stop loss is 1.2190. Implementation period: 2 days.

The breakdown of the current support levels can be the signal to open short positions. The “bearish” targets will be the psychological level of 1.2000. Stop loss is 1.2300. Implementation period: 2-3 days.

No comments:

Write comments