Brent Crude Oil: technical analysis

07 September 2017, 12:23

| Scenario | |

|---|---|

| Timeframe | Intraday |

| Recommendation | BUY |

| Entry Point | 54.42 |

| Take Profit | 55.00 |

| Stop Loss | 54.20 |

| Key Levels | 52.00, 52.50, 53.00, 53.50, 54.10, 54.50, 55.00 |

| Alternative scenario | |

|---|---|

| Recommendation | SELL STOP |

| Entry Point | 54.00 |

| Take Profit | 53.50 |

| Stop Loss | 54.30 |

| Key Levels | 52.00, 52.50, 53.00, 53.50, 54.10, 54.50, 55.00 |

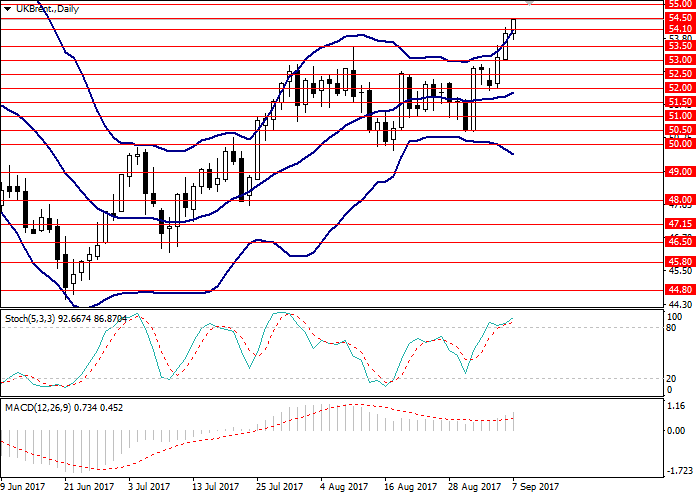

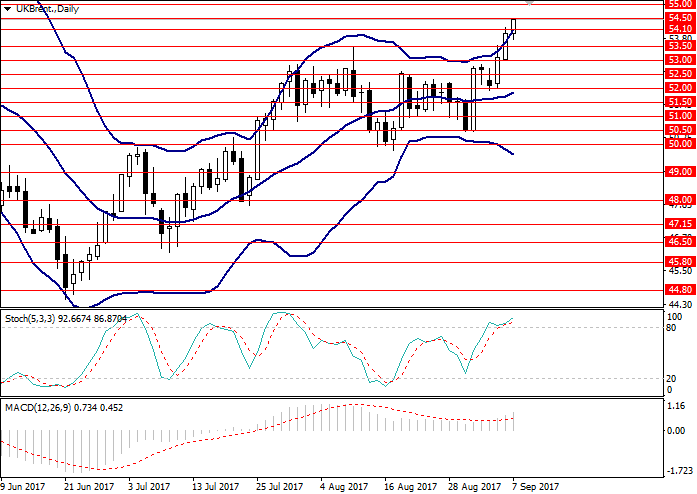

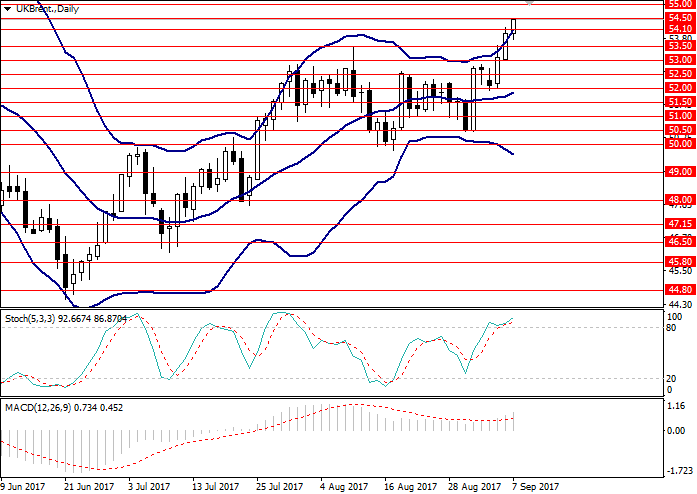

Brent, D1

On the D1 chart the instrument is growing having broken through the resistance level of 54.10 marked by the upper line of Bollinger Bands. The price range is widened which may indicate possible continuation of the upward trend. MACD histogram is in the positive zone preserving the signal for the opening of buy orders. Stochastic has crossed the border of the overbought area from below.

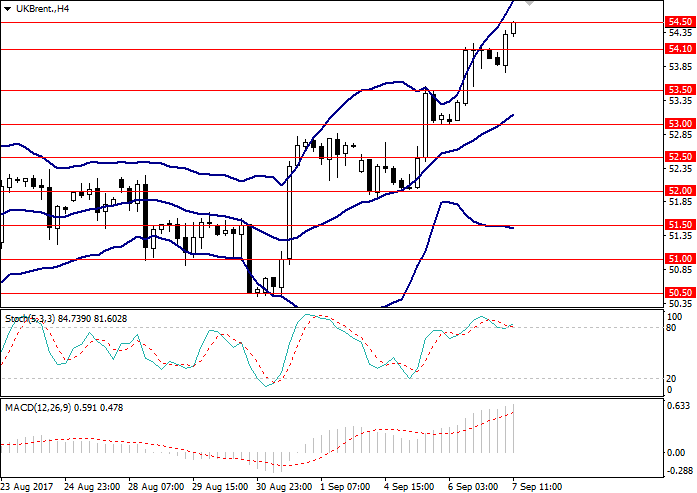

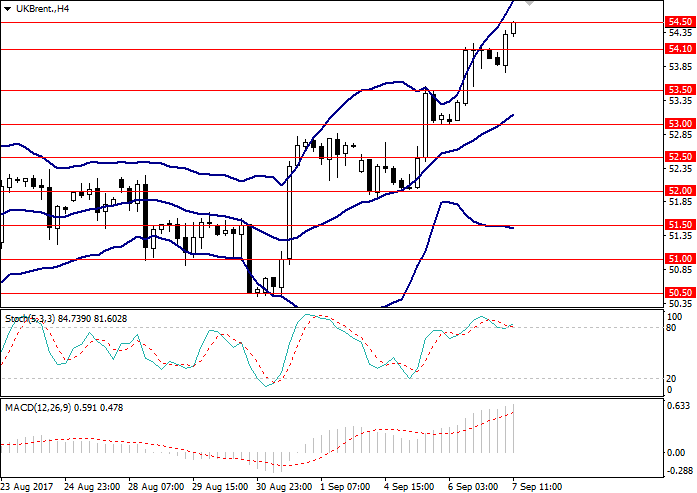

Brent, H4

On H4 chart the instrument is growing along the upper border of Bollinger Bands, and the price range is widened. MACD histogram is in the positive area and gaining volumes. The signal line is crossing the body of the histogram from below giving a signal for opening long positions. Stochastic is at the border of the neutral and overbought zones. In case the border is crossed from below it will be a signal for opening sell orders.

Key levels

Support levels: 54.10, 53.50, 53.00, 52.50, 52.00.

Resistance levels: 54.50, 55.00.

Trading tips

The opening of long positions seems preferable from the key price level with target at 55.00 and stop-loss at 54.20. The period of implementation is 1-2 days.

Short positions may be opened from the level of 54.00 with target at 53.50 and stop-loss at 54.30. The period of implementation is 2-3 days.

On the D1 chart the instrument is growing having broken through the resistance level of 54.10 marked by the upper line of Bollinger Bands. The price range is widened which may indicate possible continuation of the upward trend. MACD histogram is in the positive zone preserving the signal for the opening of buy orders. Stochastic has crossed the border of the overbought area from below.

Brent, H4

On H4 chart the instrument is growing along the upper border of Bollinger Bands, and the price range is widened. MACD histogram is in the positive area and gaining volumes. The signal line is crossing the body of the histogram from below giving a signal for opening long positions. Stochastic is at the border of the neutral and overbought zones. In case the border is crossed from below it will be a signal for opening sell orders.

Key levels

Support levels: 54.10, 53.50, 53.00, 52.50, 52.00.

Resistance levels: 54.50, 55.00.

Trading tips

The opening of long positions seems preferable from the key price level with target at 55.00 and stop-loss at 54.20. The period of implementation is 1-2 days.

Short positions may be opened from the level of 54.00 with target at 53.50 and stop-loss at 54.30. The period of implementation is 2-3 days.

No comments:

Write comments